Credit Card Fraud Detection Process

Credit card fraud is an inclusive term for fraud committed using a payment card such as a credit card or debit card.

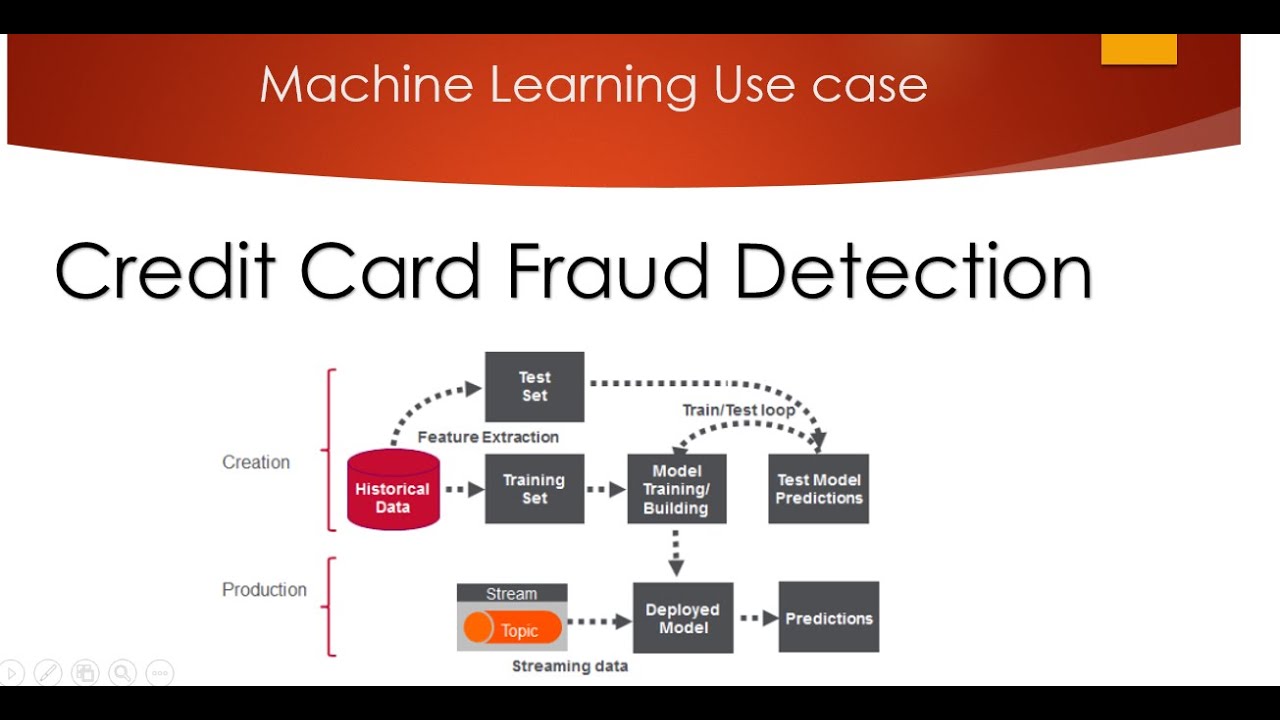

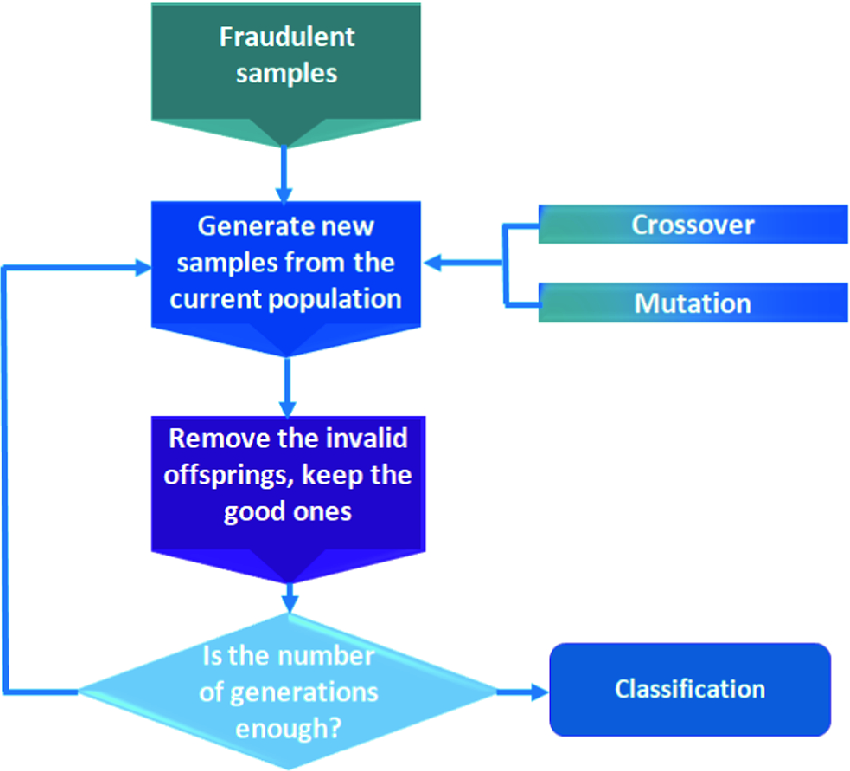

Credit card fraud detection process. Credit card fraud detection. On a global scale credit card processing fraud has hit 32 320 trillion in total with 21 84 billion lost in the us only. Nowadays credit card fraud detection is of great importance to finan cial institutions. Credit card fraud detection with machine learning is a process of data investigation by a data science team and the development of a model that will provide the best results in revealing and preventing fraudulent transactions.

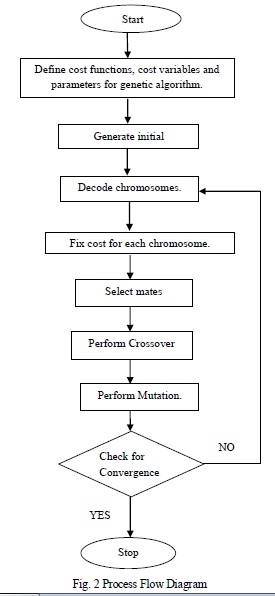

The purpose may be to obtain goods or services or to make payment to another account which is controlled by a criminal. This audit work program identifies and evaluates the effectiveness of a debit and credit card service provider s fraud prevention process. Debit or credit card fraud detection processing using rpa saturday feb 15 2020 written by aishwarya kannan there is a prevailing fraudulent rate of 72 8 percent per 1000 reflecting the growing growing trend of online card fraud and cybercrime. In this process we have focused more on analyzing the feature modeling and possible business use cases of the algorithm s output than on the algorithm itself.

While there are a lot of methods to limit the loss and prevent fraud and i ll walk you through my process and show you my findings. Credit card fraud detection happens through a fine grained process of analyzing credit card transactions and recognizing patterns and spending profiles. Even with emv smart chips being implemented we still have a very high amount of money lost from credit card fraud. Why fraud detection in banking systems is so important today.

The payment card industry data security standard pci dss is the data security standard created to help businesses process card payments securely and reduce. This article presents an automated credit card fraud detection sys tem based on the neural network technology. S to keep this blog ad free this post may contain affiliate links and or paid placement. Automating the pipeline article 2 we will compare various model on the same problem on by one side by side to make it easier for us to decide which model gives the best results based on various evaluation matices.

It views the reports utilized to monitor fraudulent activities involving debit and credit cards and system settings intended to identify potentially fraudulent transactions.