Bank Islam Personal Loan 2019

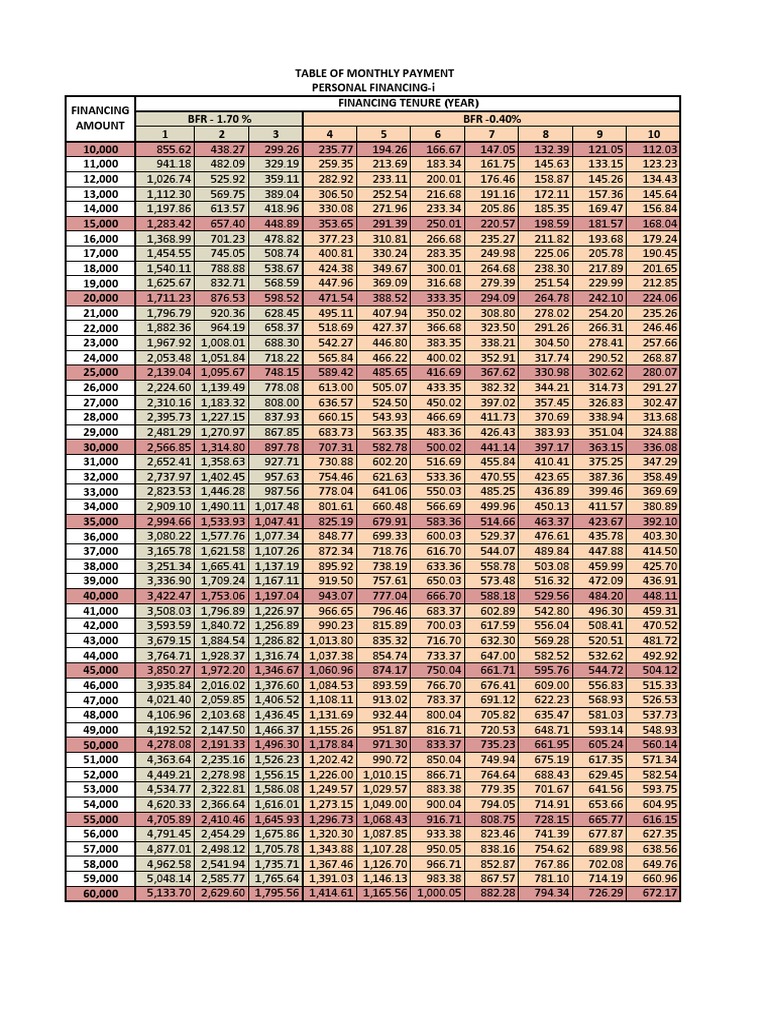

Bank islam repayment table 2019 archives.

Bank islam personal loan 2019. Having takaful means that you can enjoy better interest rates and having protection for your installments in case of unfortunate incident. It has made long strides to become a global leader in islamic banking and in upholding its status as the symbol of islamic banking in malaysia. The personal loan also comes with a minimum income requirement of rm1 500. Bank islam personal financing i package with bank islam personal financing i package the personal loan comes with an fixed interest rate starting from 4 9 p a.

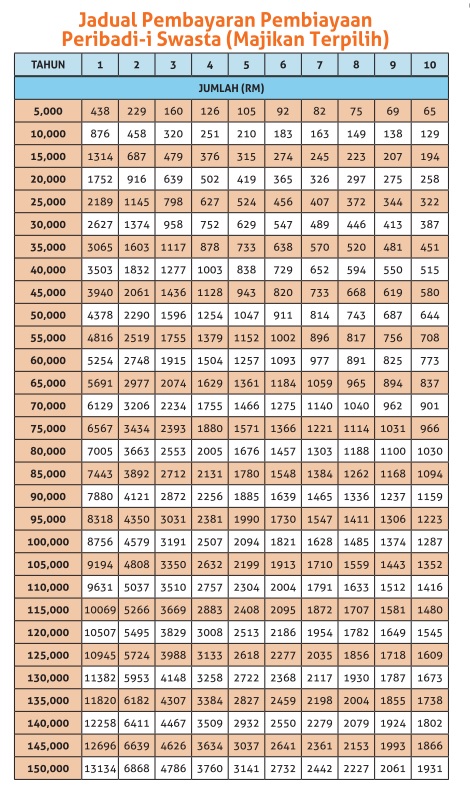

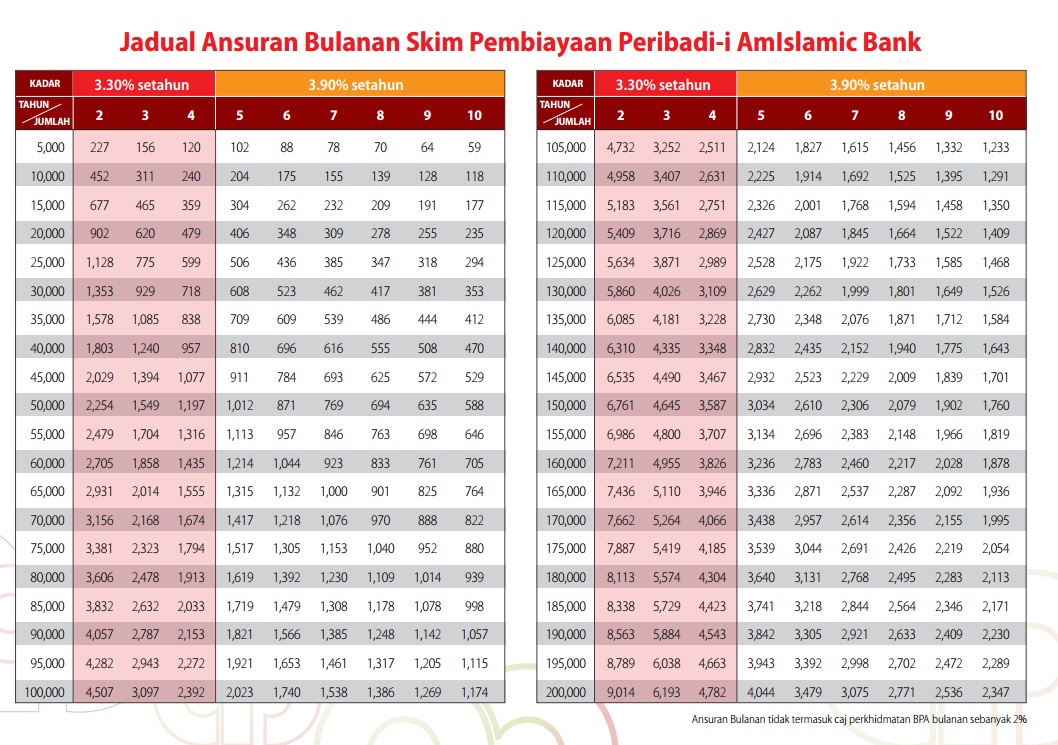

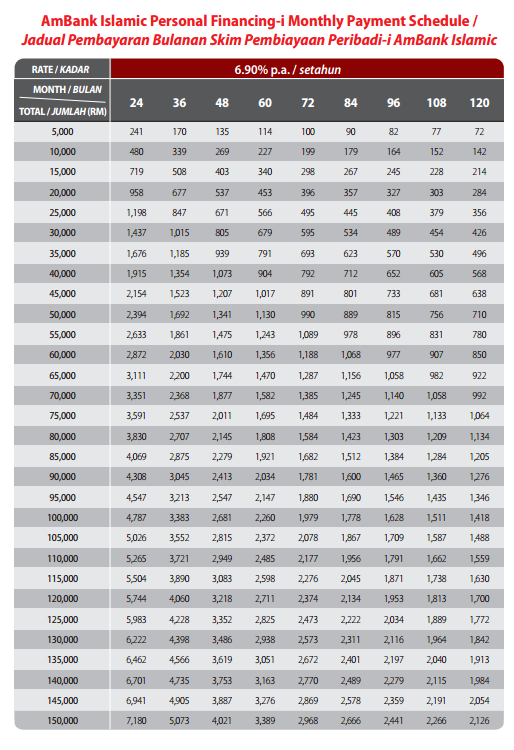

The amount of loan available is from rm 10 000 to rm 200 000. However borrowers will have to apply to their respective banks to avail this facility. Posted on september 11 2019 by admin. One point that differentiate this personal loan is there are options for fixed or floating interest rates.

The loan amount would be subjected to criteria such as monthly income and credit score. As of personal loans in malaysia there are no collateral nor guarantor is needed for the loan. The shariah concept applicable is tawarruq. Tawarruq also known as reverse murabahah refers to the process of purchasing a commodity for a deferred price determined through musawama bargaining or murabaha mark up sale and selling it to a third party for a spot price so as to obtain cash.

Bank islam personal loan. Personal loan bank islam 2019 personal loan bank islam rate personal loan bank islam table 2019 personal loan bank islam untuk guru table personal loan bank islam. It has a maximum tenure of 10 years. Bank islam is the pioneer of shariah based banking in malaysia and south east asia.

This personal loan has a maximum tenure of 10 years. Applicants can even loan more than rm 200 000 if they provide collateral as security to bank islam. Options of fixed or floating interest rates and takaful coverage. Personal financing i non package.

Bank islam was established in 1983 to address the financial needs of malaysia s muslim.