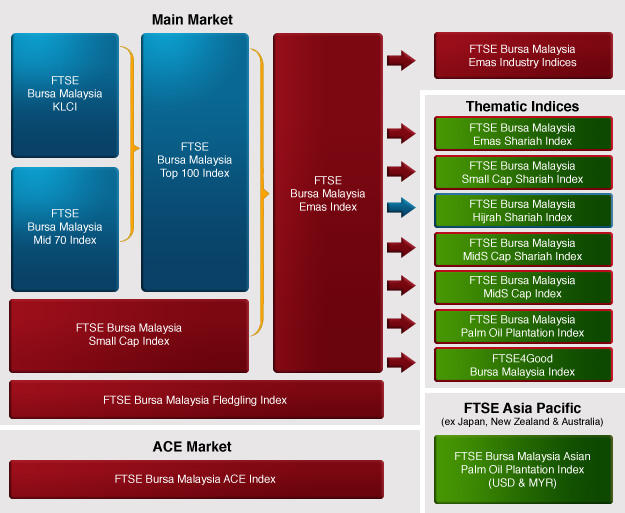

Bursa Malaysia Main Market And Ace Market

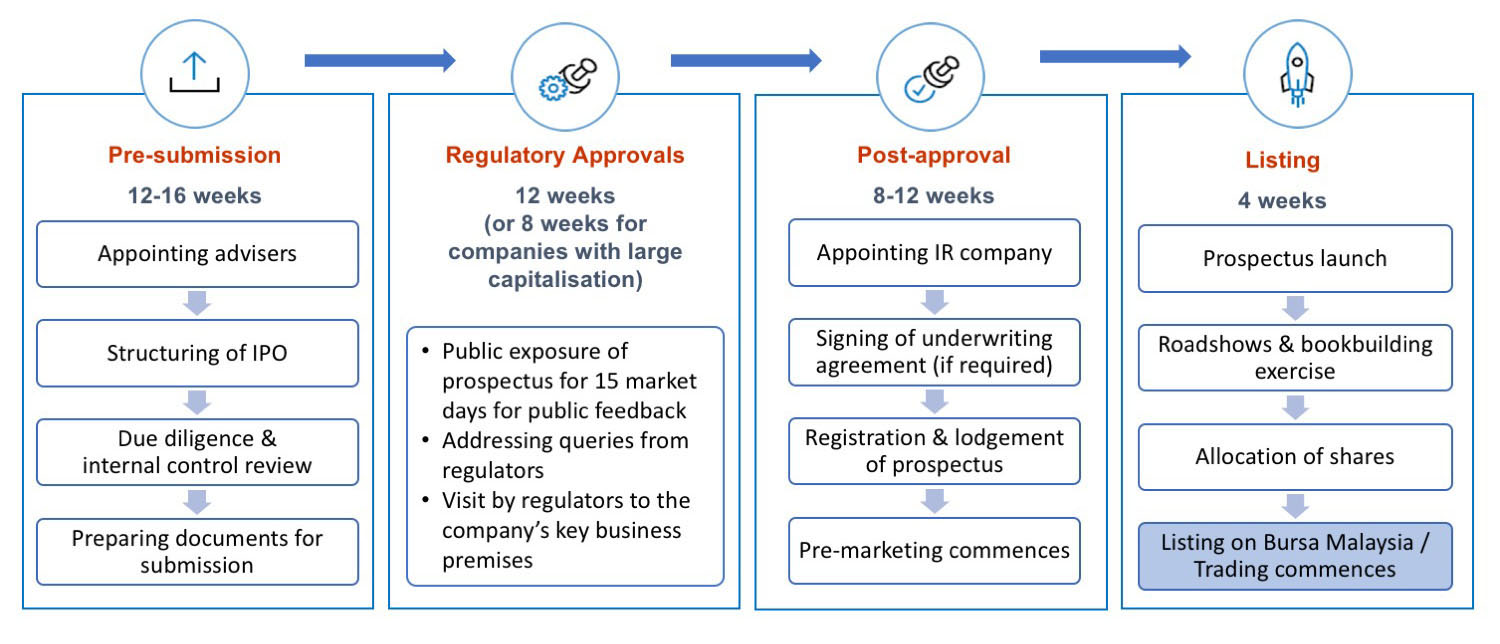

Kuala lumpur bursa malaysia berhad has amended the main market and ace market listing requirements to enhance the disclosure requirements in connection with new issue of securities as well as address gaps for greater shareholder protection and confidence the exchange announced in a statement on august 13.

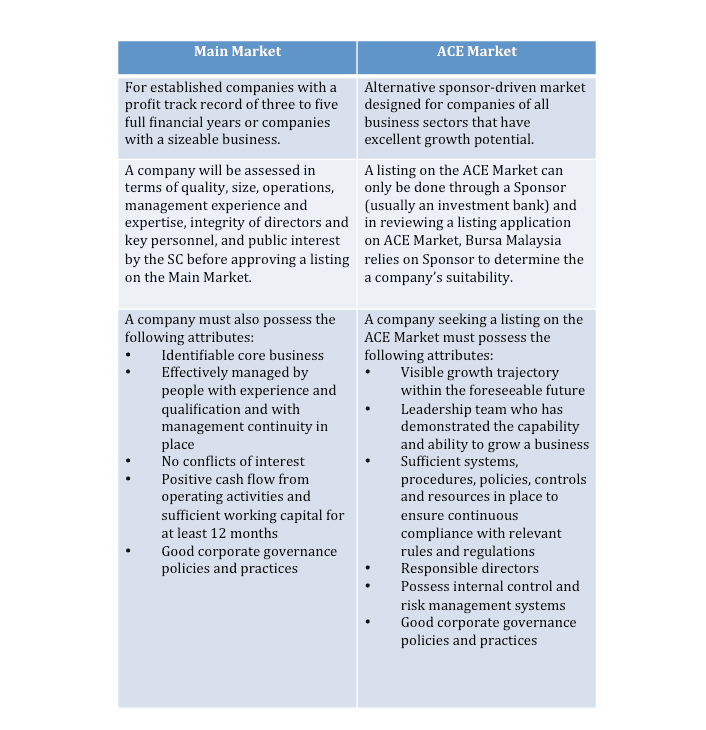

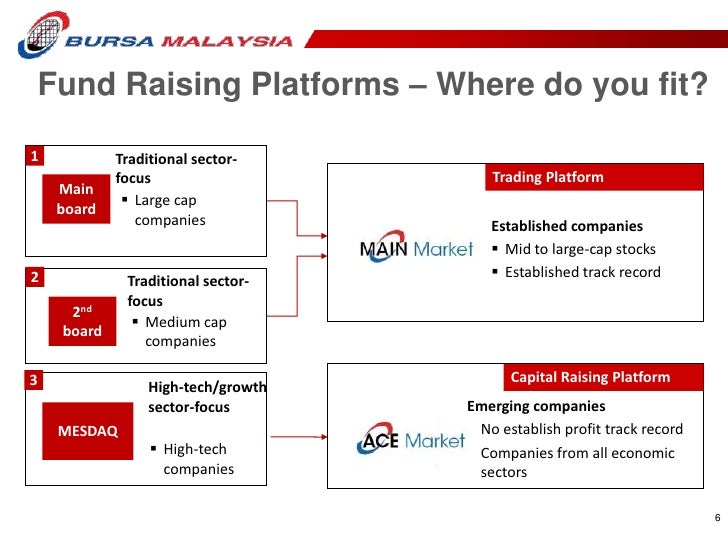

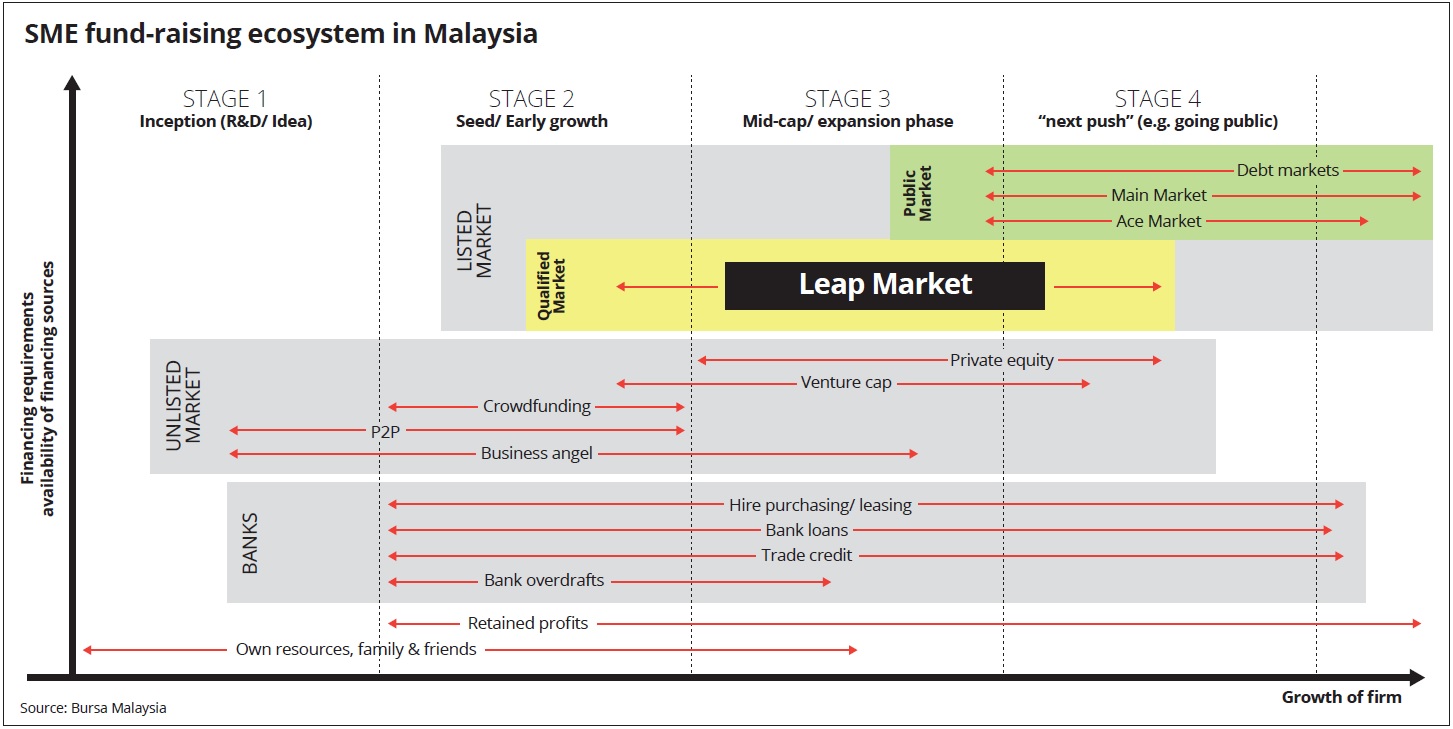

Bursa malaysia main market and ace market. In regard to the listing managing director pang tse. It made malaysia the first asean country to have an alternative capital raising platform for underserved small and medium enterprises smes. The ace market was derived together with the unification of the main and second board into the main market of bursa malaysia in 2009. It was formerly known as the mesdaq market prior to 3 august 2009.

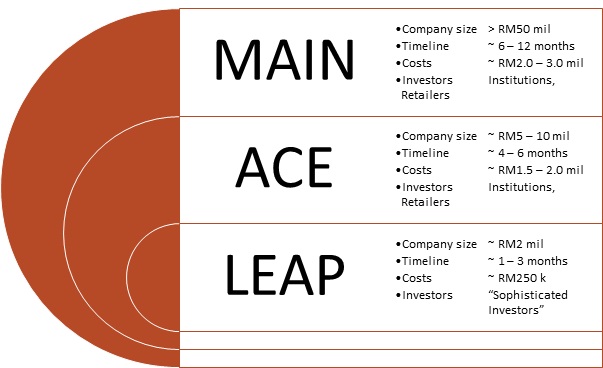

Ace market is a sponsor driven market designed for companies with growth prospects. Sponsors must assess suitability of the potential issuers taking into consideration attributes such as business prospects corporate conduct and adequacy of internal control. To this end the main ace and leap markets are now more specialized offering investors a better and effective way of trading. For enquiries on listed companies click here to download contact list.

Bursa saw the first listing on the leap market in october 2017. Companies on bursa malaysia are listed under either the main or ace markets. The ace market is seen as the ideal market for start ups and new companies which are run by entrepreneurs who are looking to push for more capital by listing their companies public. Bursa malaysia s leading entrepreneur accelerator platform better known as the leap market was launched in 2017 during the tenure of former bursa ceo datuk seri tajuddin atan.

The main market in bursa malaysia is now the combination of both the markets. The ace market was derived together with the unification of the main and second board into the main market of bursa malaysia in 2009. Links to the companies websites are provided in the list. Total door systems solution provider econframe bhd econframe made its debut on bursa malaysia s ace market today at 34 5 sen compared with its initial public offering ipo price.

The ace market is seen as the ideal market for start ups and new companies which are run by entrepreneurs who are looking to push for more capital by listing their companies public.