Tax Evasion Cases In Malaysia

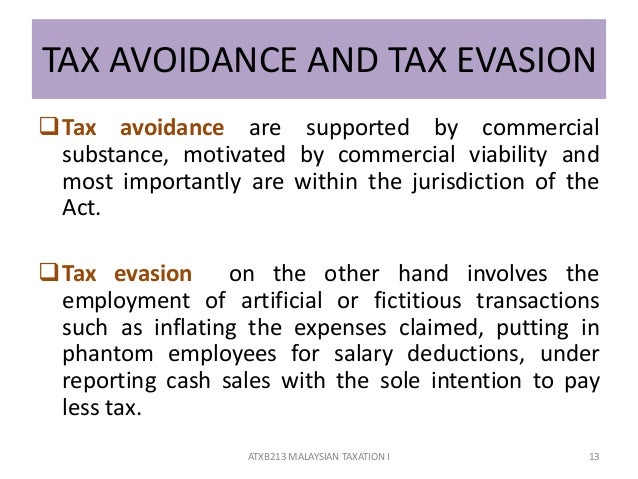

Though both are illegal tax avoidance means failure to file for income tax without a reasonable excuse.

Tax evasion cases in malaysia. This is so you don t suddenly fall off the grid which could put you in a high risk profile for tax evasion. And that could make you a candidate for a tax audit to verify your tax returns. In the case of detection of tax offence such as fraud wilful defraud or negligence the irbm is empowered to conduct. However one must not confuse tax avoidance with tax evasion.

Likewise this department has the obligation to keep taxpayers tax affairs confidential under the same secrecy provision. Kuala lumpur may 18 the hearing of datin seri rosmah mansor s case for money laundering and tax evasion involving rm7 097 750 which was set for this month has been vacated to make way for her ongoing corruption trial involving the solar hybrid project for rural schools in sarawak. According to lhdn you can be audited for up to 5 years of assessment and there is no time limit on the audit if there is fraud or tax evasion so you ll want to make sure your tax accounts are in order. Israeli court sentences top model bar refaeli for tax evasion sep 15 2020 5 00 am 10 weeks jail 4 000 fine and 262 000 penalties for woman who evaded gst and taxes.

The irb managed to solve nearly 1 9 million tax evasion cases in 2012 to recoup an additional rm2 94 billion in revenue. Tax evasion in most jurisdictions including malaysia is illegal and gives rise to substantial civil and criminal sanctions. Please take note that the source of information leading to a case review would be kept confidential according to the requirements of the secrecy provision under section 138 of income tax act 1967. Many more charges follow including tax evasion and tampering with an official report into 1mdb.

Najib s wife rosmah pleads not guilty to money laundering and tax evasion charges. Another option available to the taxpayer is to apply to the high court for a stay of execution as has been decided in kerajaan malaysia v jasanusa sdn bhd 1995 2 clj 701 sc. The higher number of tax evasion cases and increase in the statistics of unpaid tax in malaysia shows that malaysian citizens still rationalize that the act of tax evasion as tolerable and acceptable. Additional assessments irbm will further investigate your expenditure and income.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)