Tax Avoidance In Malaysia

This item is available to borrow from 1 library branch.

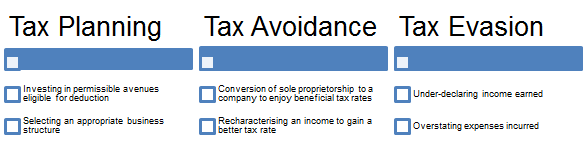

Tax avoidance in malaysia. The ibraco peremba case the taxpayer in this case a property developer purchased land in 1992 for long term investment purposes and built commercial properties to be leased out. In malaysia there are. Return form rf filing programme for the year 2020 amendment 1 2020 return form rf filing programme for the year 2020 amendment 2 2020. In malaysia income tax act contains general and specific anti avoidance provision which empowers the director general to disregard schemes that are not commercially justified or are merely set up to avoid tax despite their legal form.

One thing worth mentioning is malaysia has an extensive number of double tax treaties available for the avoidance of double taxation. Principles and cases represents a specific individual material embodiment of a distinct intellectual or artistic creation found in international bureau of fiscal documentation. I the income tax and ii the petroleum income tax hereinafter referred to as malaysian tax. In the remaining parts of the article i will discuss examples of cases that would highlight the good the bad and the ugly of section 140 of the act.

Section 140 of the act is indeed an anchor provision concerning tax avoidance. Upon advice from its tax advisor it undertook the following. Income tax in malaysia is imposed on income accruing in or derived from malaysia resident and business. Republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income malaysia and.

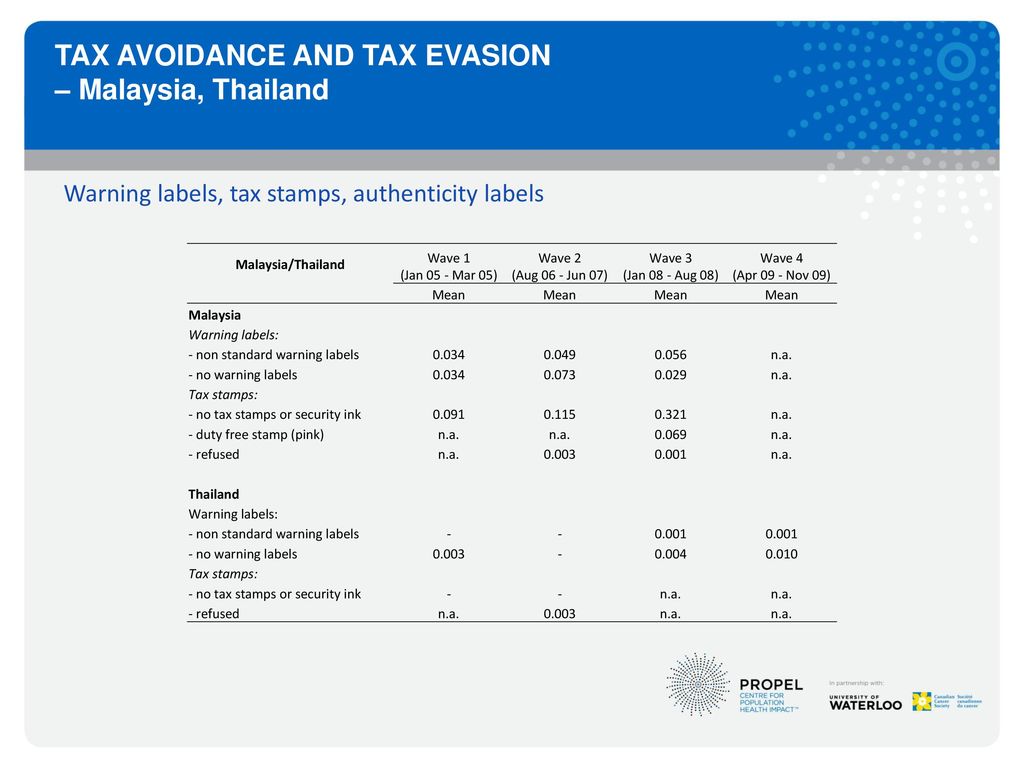

The item tax avoidance in malaysia. Thus in most tax jurisdictions anti avoidance provisions are included in the tax laws to defeat or pre empt anticipated avoidance schemes mischief or to plug loopholes that have come to light. 2 tax avoidance pwc alert issue 116 october 2014. It was conducted using cross sectional data by observing a final sample of 82 plcs at one point in time.

Return form rf filing programme for the year 2020. From the perspective of revenue authorities it is equally important to counter tax avoidance.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)