Sports Development Act 1997 Malaysia Tax Relief

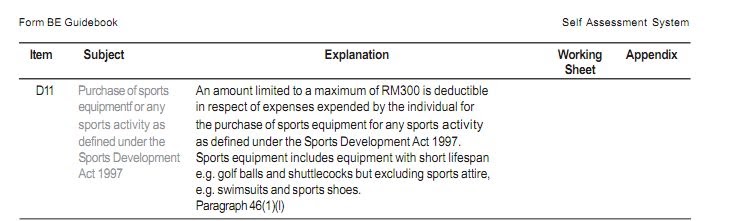

Lhdn states in the income tax act that the tax relief for sports equipment is only eligible for those used in sporting activities defined in the sports development act 1997.

Sports development act 1997 malaysia tax relief. Tax relief rebate eduction income credit end year of assessment 2015 malaysia www hasil gov my lembaga hasil dai am ne geri malaysia lhdnm r07 16 tax reliefs tax reliefs which can be. 6 laws of malaysia act 576 7sports development laws of malaysia act 576 sports development act 1997 an act to promote and facilitate the development and administration of sports in malaysia and to provide for matters incidental thereto. Except sabah sarawak and federal territory of labuan. The term equipment is not defined and is thus open to discussion.

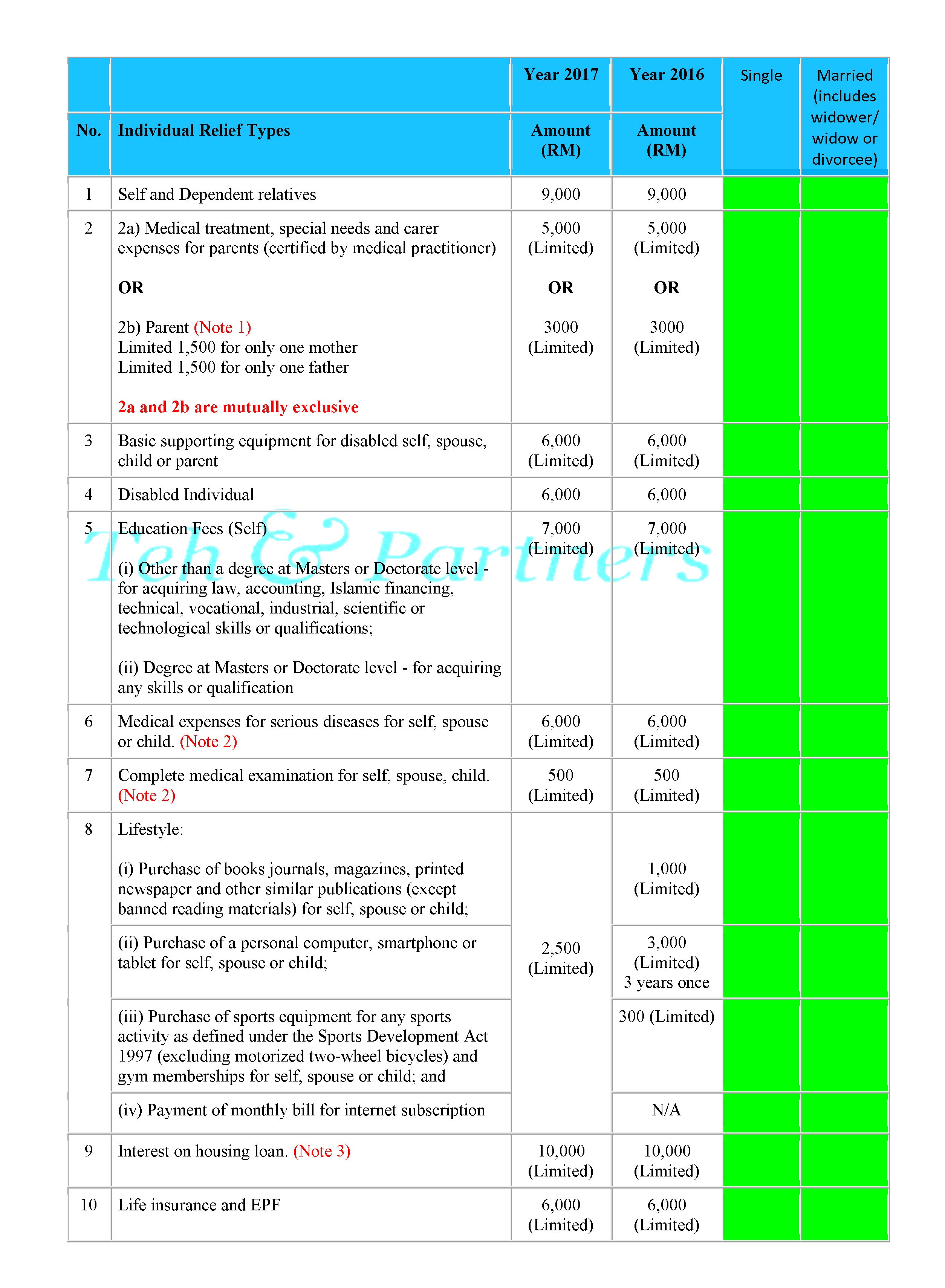

Kuala lumpur oct 15 instead of rm1 000 as previously implemented parents can now claim a tax relief of rm2 000 if they have a six year old child sent to a kindergarten or pre school registered with the department of social welfare jkm. Year of assessment 2019. Receiving further education outside malaysia in respect of an award of degree or its. 2 iv payment of monthly bill for internet subscription.

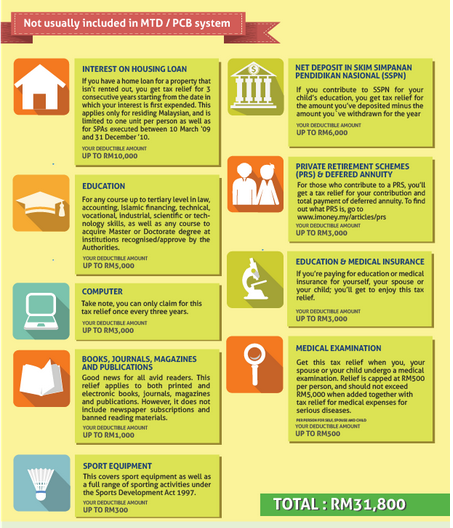

The tax relief is among the provisions contained in the. Tax relief of up to myr 300 for the purchase of sports equipment for sports activities as defined under the sports development act 1997. Internet subscription paid through monthly bill registered under your own name. Purchase of sports equipment for any sports activity as defined under the sports development act 1997 not eligible for the purchase of sports.

Rm 2 500 including child spouse. Tax relief of up to myr 3 000 for the purchase of a computer to be claimable once over a three year period. From the year 2008 individual taxpayers are allowed to claim tax deduction of up to rm300 a year on purchase of equipments for sports as defined by the sports development act 1997. Sports equipment for sports activities defined under the sports development act 1997 including golf balls and shuttlecocks but excluding motorised bicycles and payment for gym membership excluding club membership which provides gym facilities.

Can be considered as sports equipment. And contributions to sports body approved by the commissioner of sports appointed under the sports development act 1997 contributions are restricted to cash. Purchase of sports equipment for any sports activity as defined under the sports development act 1997 excluding motorized two wheel bicycles and gym. 1 january 1998 p u.

Malaysia approved by the dgir the following contributions gift of money or in kind made qualify for deduction contributions for sports activity approved by the minister of finance.