Resident Status In Malaysia

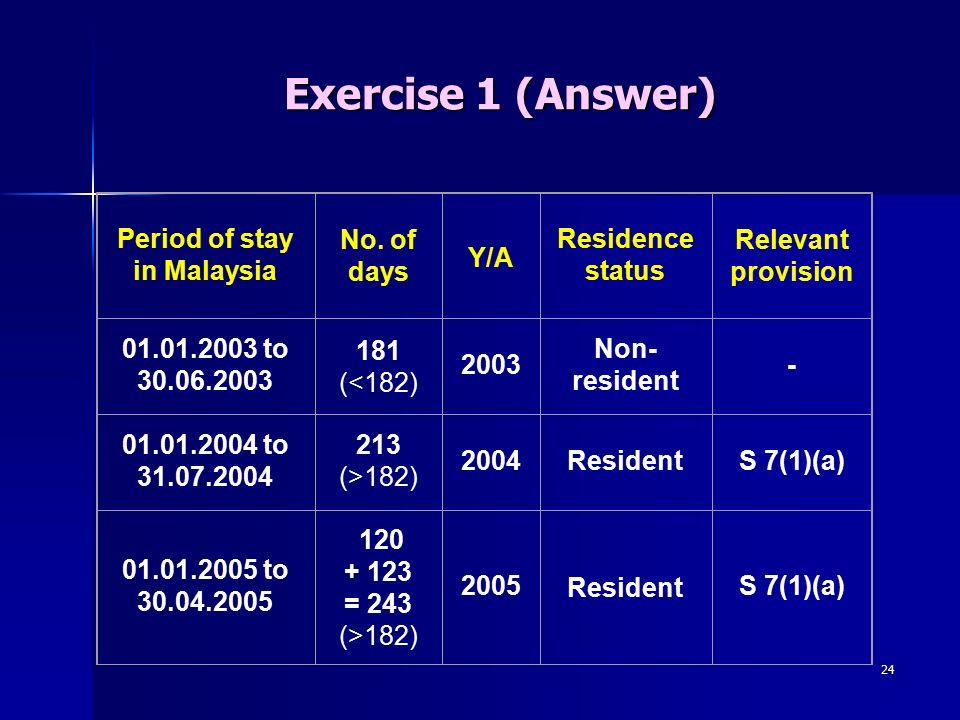

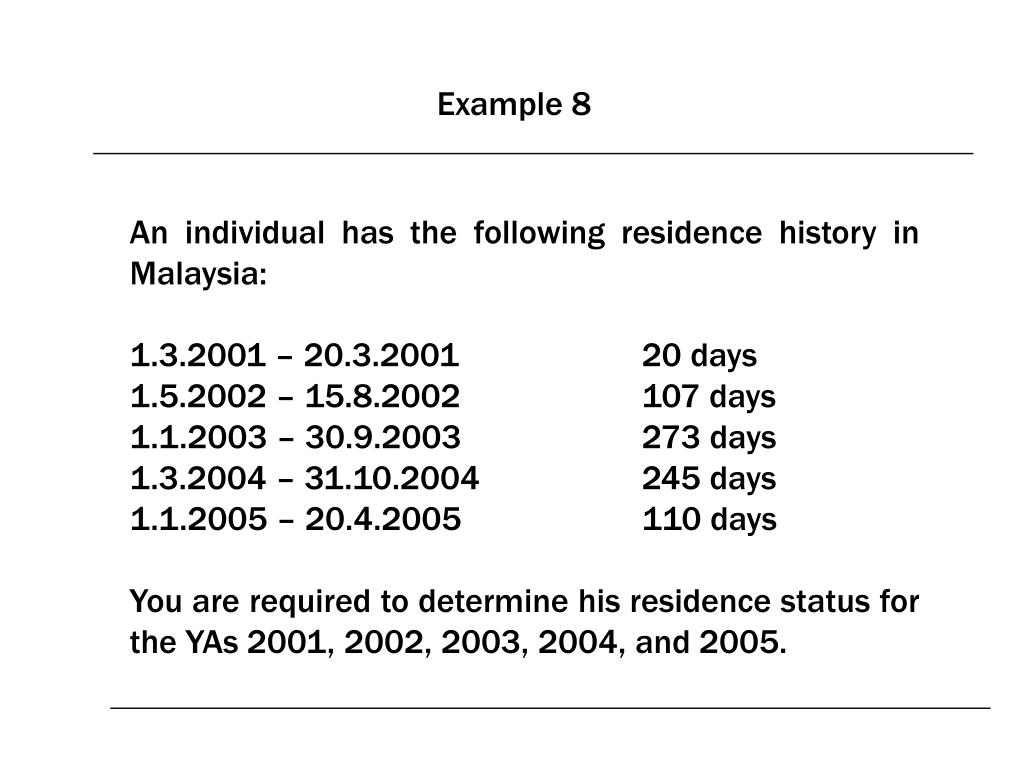

A page 6 of 19 anil was a non resident in malaysia for the basis year for the year of assessment 2010 as he was present in malaysia for less than 182 days in the year 2010.

Resident status in malaysia. Inland revenue board malaysia residence status of individuals public ruling no. 6 2011 date of issue. B he is. So it is very important to identify whether you are residents or non resident in regard to malaysia tax law.

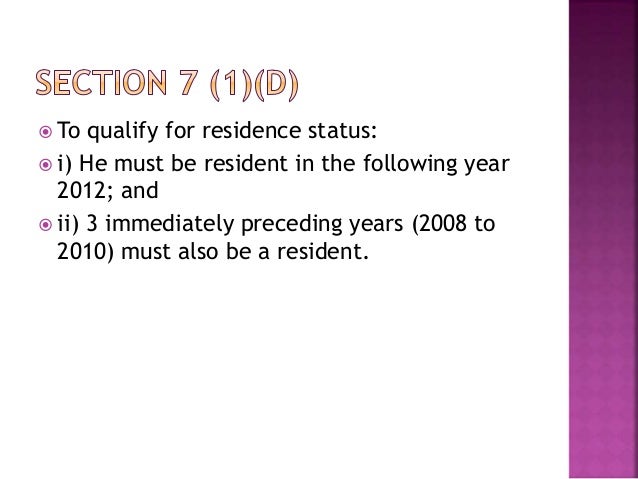

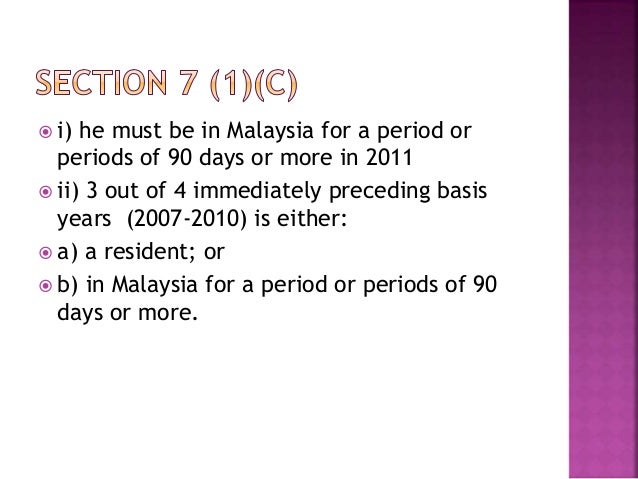

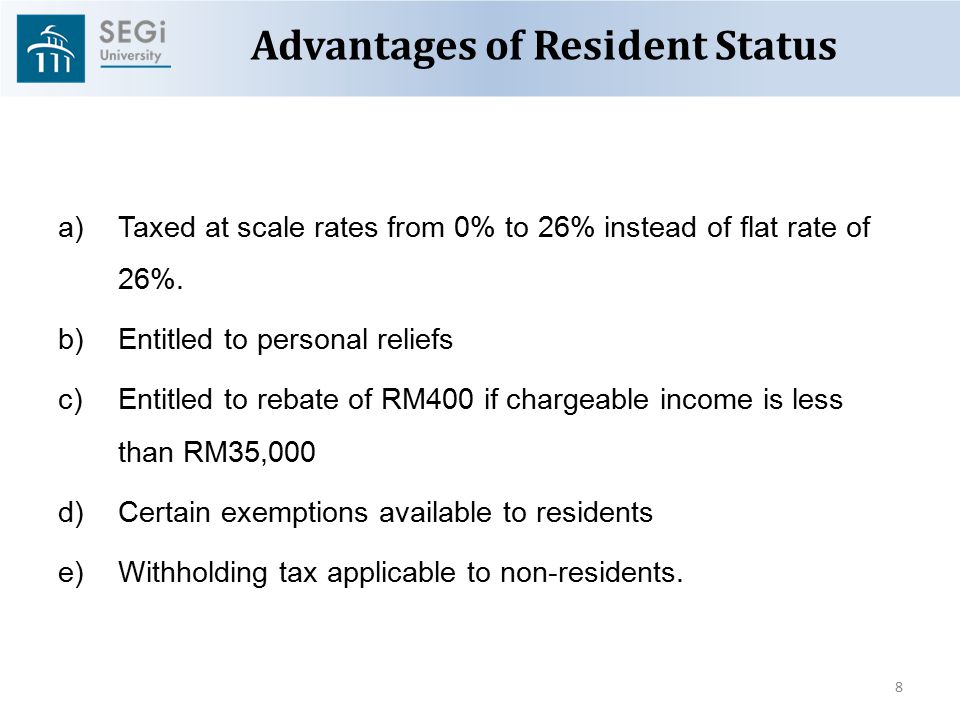

If you re looking to take your life internationally and move abroad to malaysia you ll be happy to know that there are plenty of opportunities to obtain legal residency in the country. 4 2 a resident and a non resident company in malaysia is taxed in the same. The status of individuals as residents or non residents determines whether or not they can claim personal allowances generally referred to as personal reliefs and tax rebates and enjoy the benefit of graduated tax rates. 16 may 2011 issue.

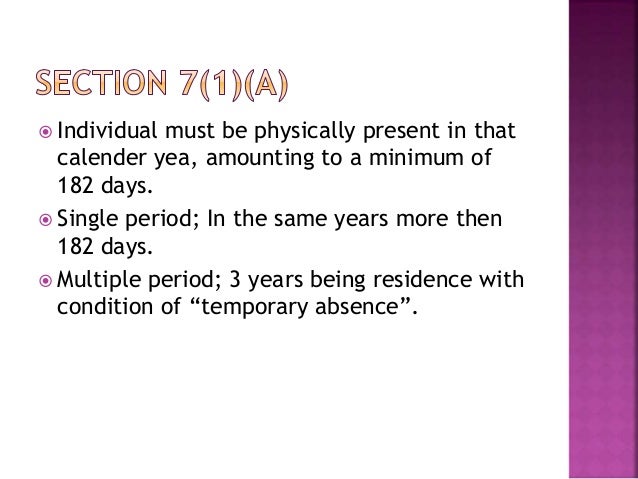

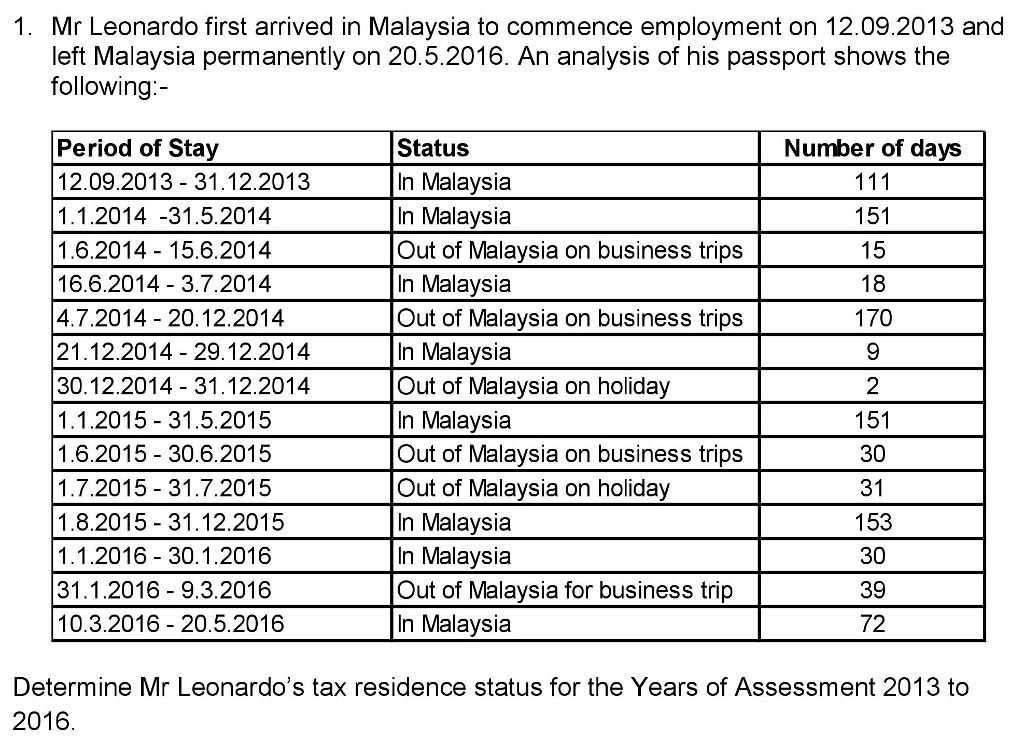

As a permanent resident you will be given a card mypr as proof of your right to stay here indefinitely. 1 for the purposes of this act an individual is resident in malaysia for the basis year for a particular year of assessment if a he is in malaysia in that basis year for a period or periods amounting in all to one hundred and eighty two days or more. If you are an individual who is temporarily present in malaysia because of covid 19 travel restrictions the period of temporary presence in malaysia because of covid 19 travel restrictions shall not be taken to form part of your period or periods in malaysia for the purpose of residence status. Malaysia is a southeast asian country known for its beaches tropical rainforests and colourful culture mixing chinese indian and european influences.

Under malaysian tax law both residents and non resident are subject to income tax on malaysian source income. What is permanent resident pr in malaysia. As defined by wikipedia a permanent resident or pr is a person s resident status in a country of which they are not citizens. A the cor is issued to enable the taxpayer that is tax residence in malaysia to get the benefit of the double taxation agreement dta that the government of malaysia has signed with her treaty partners and to avoid being tax twice on the same income by the treaty countries.

Residence status in malaysia. Residents and non resident status will give a different tax regime on income earned received from malaysia. Significance of residence status 4 1 residence status is a question of fact and it is one of the main criteria that determines the tax treatment and tax consequences of a company or body of persons.