Resident Status In Malaysia Section 7

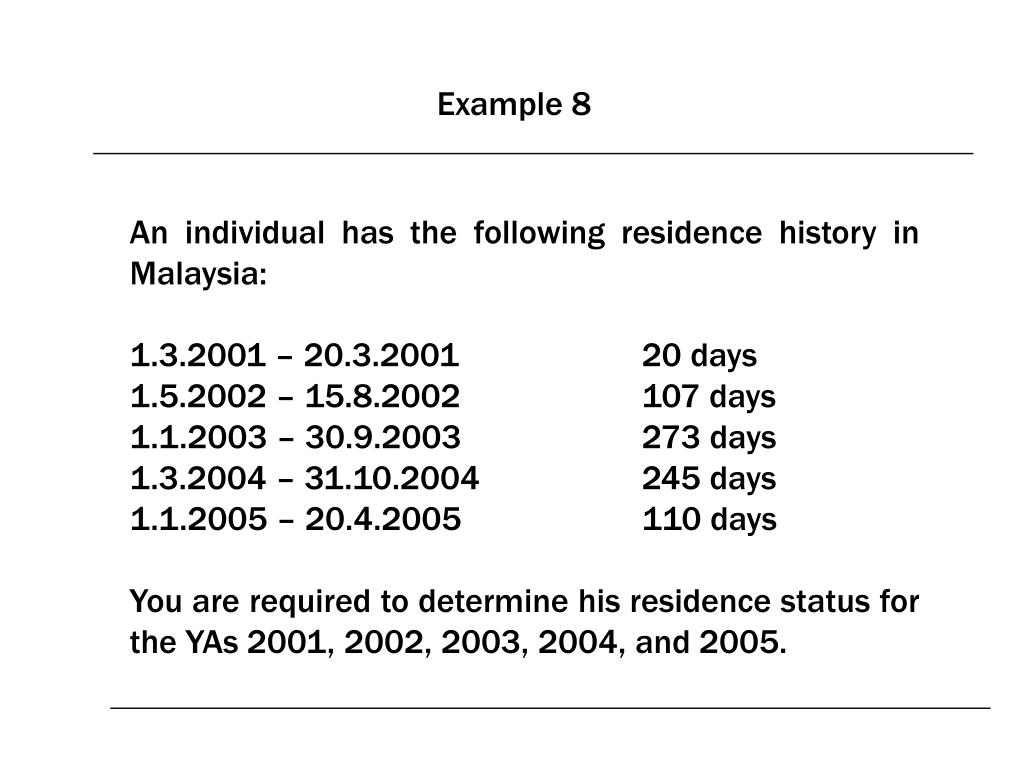

The residence status of an individual is determined under section 7 of the act.

Resident status in malaysia section 7. Significance of residence status 4 1 residence status for income tax purposes residence status is a question of fact and is one of the main criteria that determines an individual s liability to malaysian income tax. Under part ii section 7 of the income tax act 1967 the malaysian government considers an individual regardless of their nationality a tax resident if that individual fulfills one of the following criteria. 5 resident means resident in malaysia by virtue of section 8 and subsection 61 3 of the ita 1967. For a year of assessment as determined under section 7 and subsection 7 1b of the ita 1967.

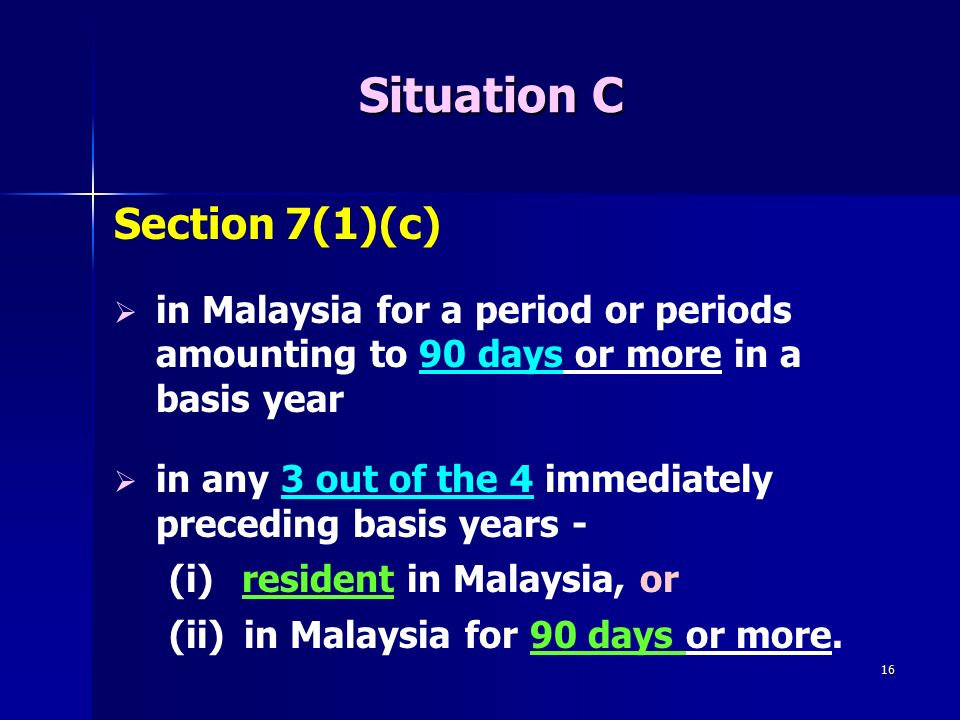

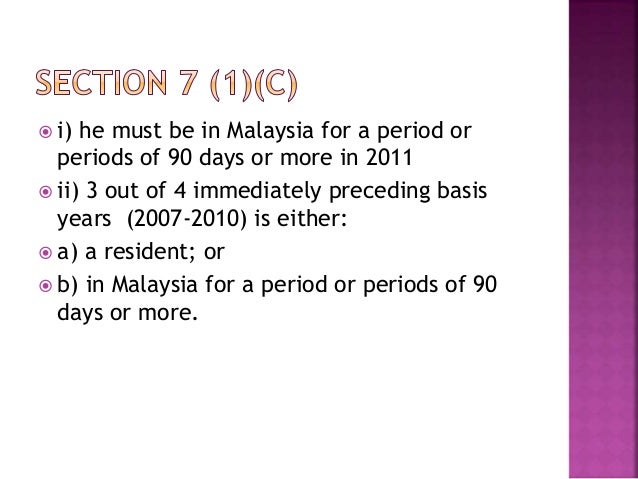

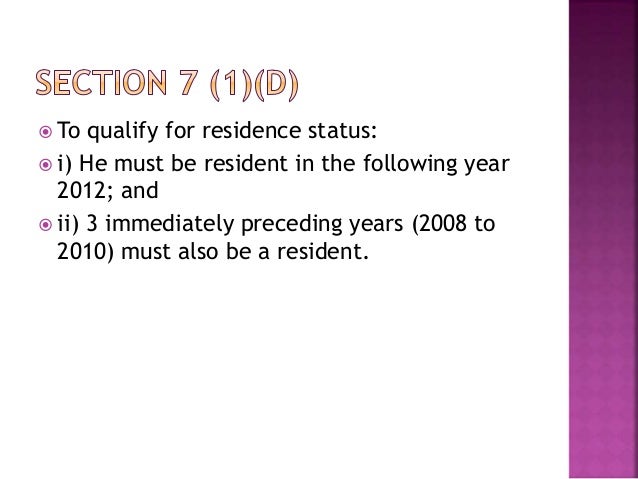

6 company means a body corporate and includes any body of persons established with a separate legal entity by or under the laws of a territory outside malaysia. Required documentation to determine residence status of a company 17 9. 1 for the purposes of this act an individual is resident in malaysia for the basis year for a particular year of assessment if. Dual residence status and double taxation avoidance agreements 17 8.

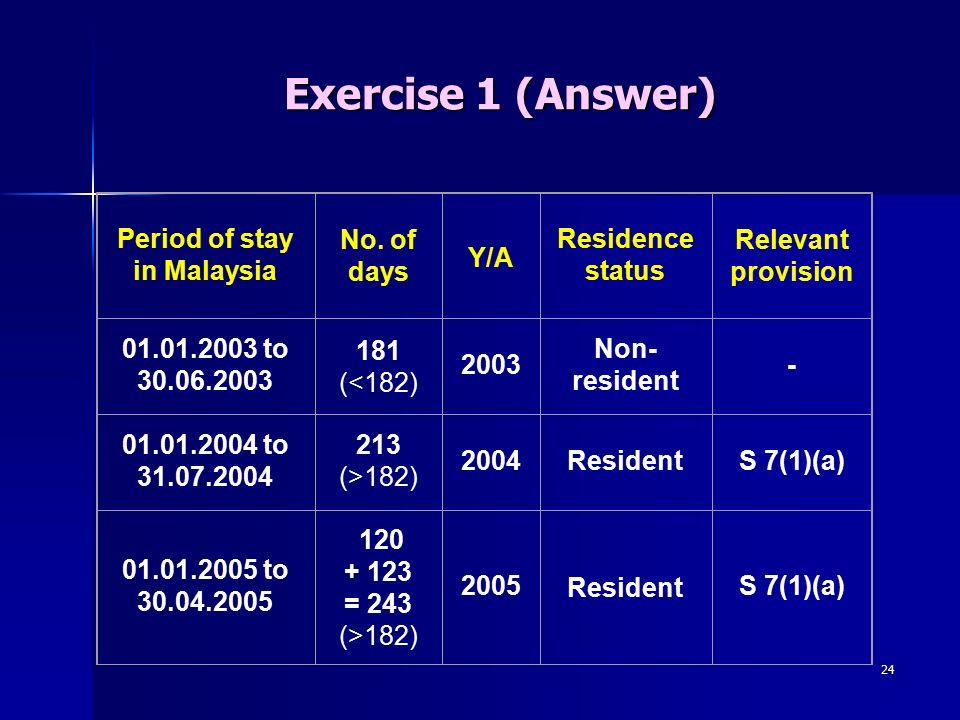

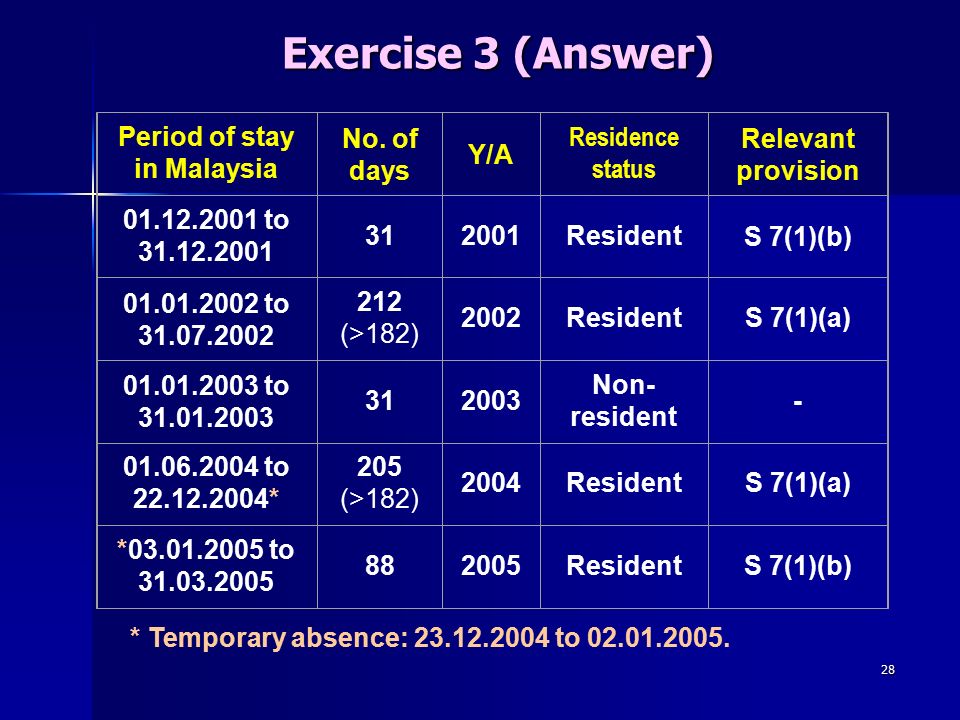

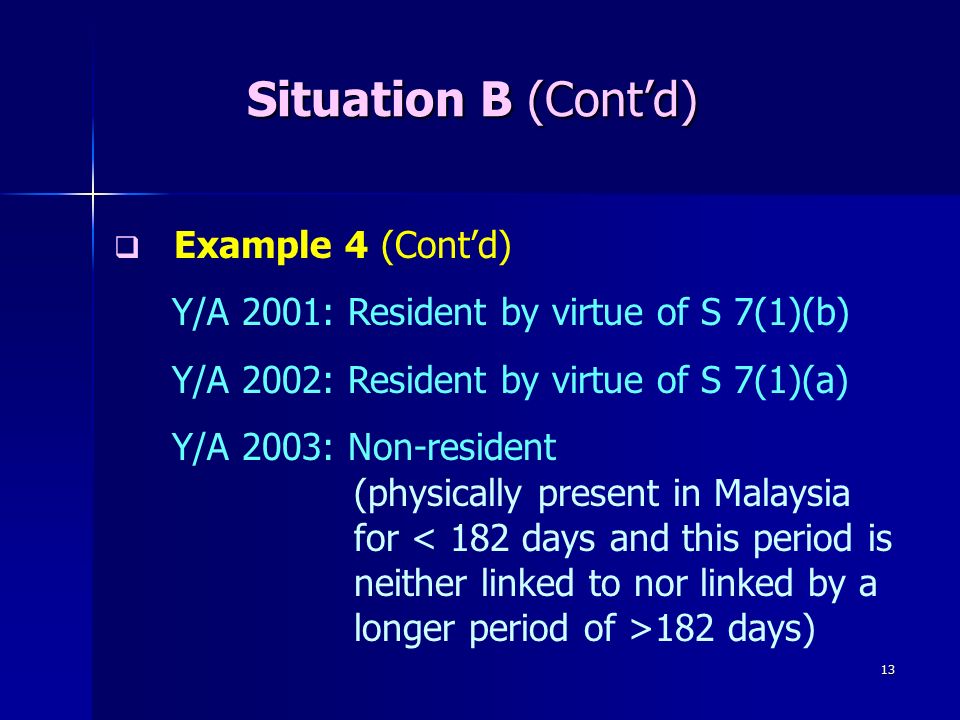

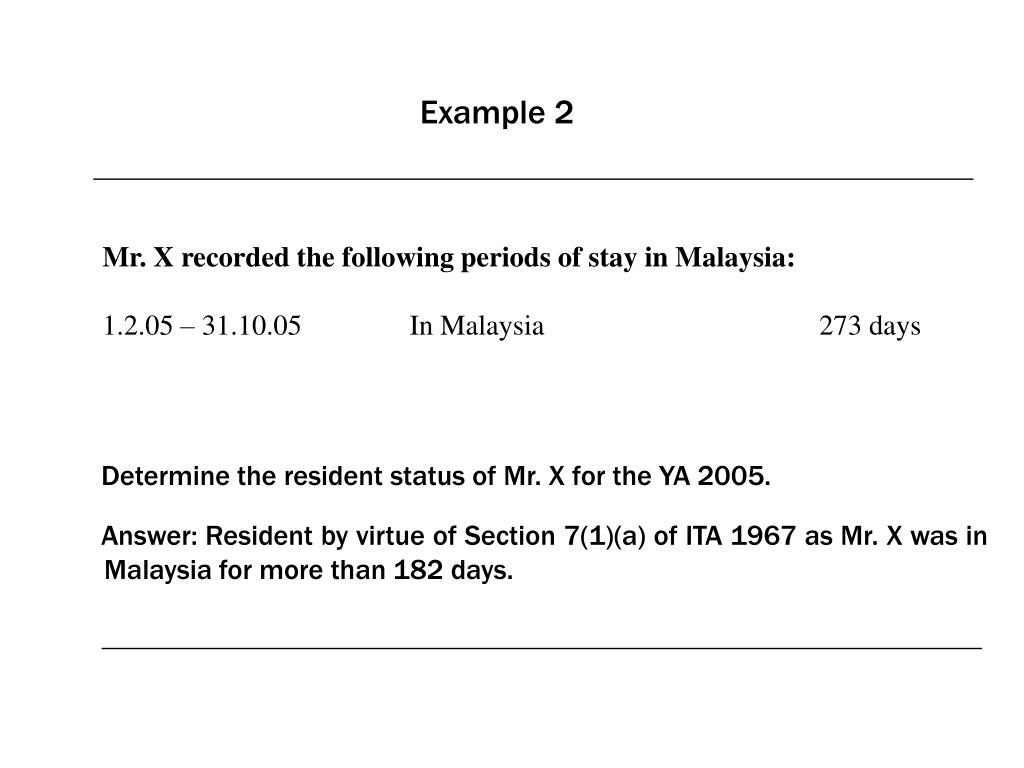

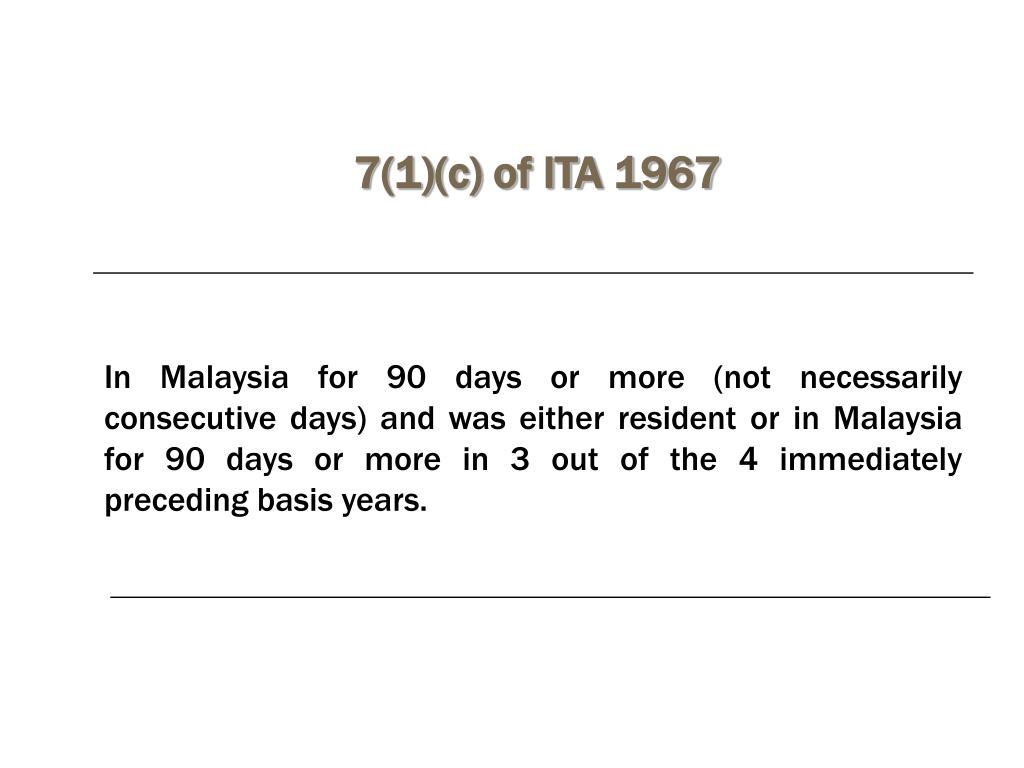

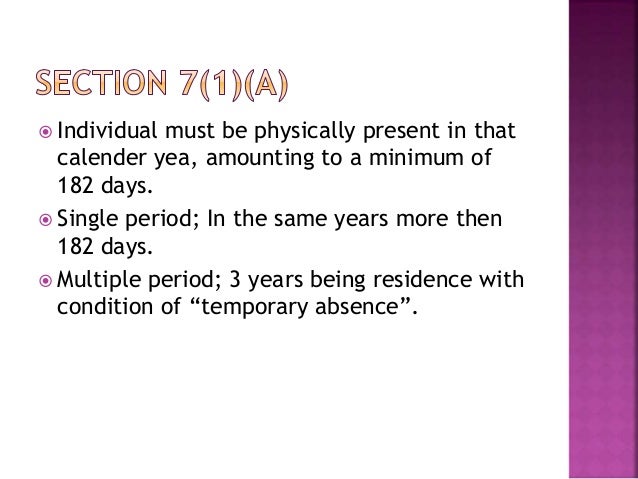

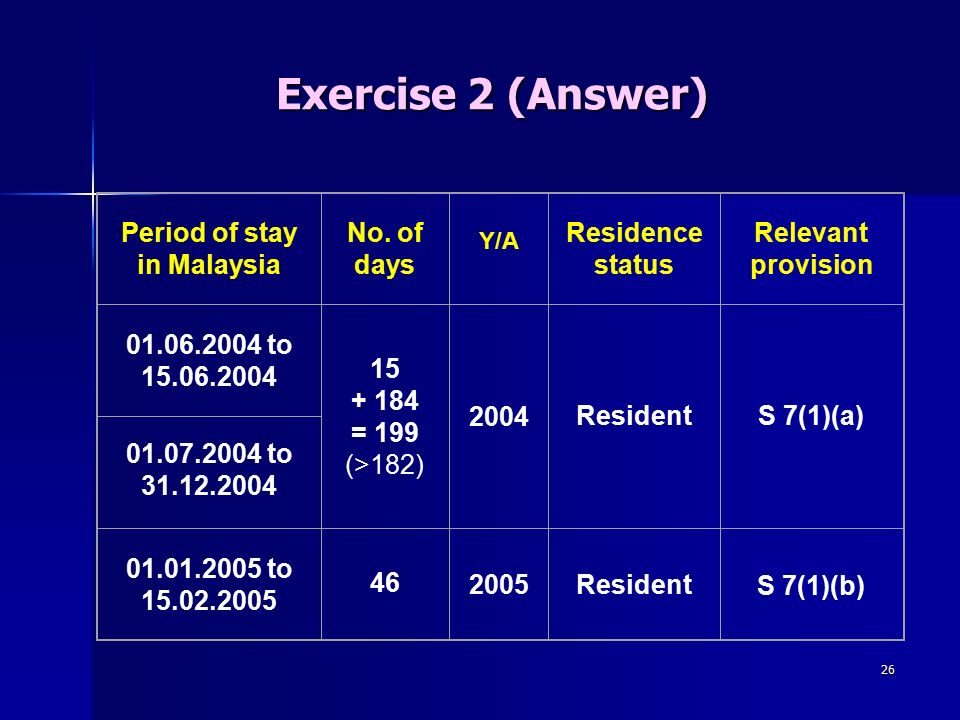

1 for the purposes of this act an individual is resident in malaysia for the basis year for a particular year of assessment if a he is in malaysia in that basis year for a period or periods amounting in all to one hundred and eighty two days or more. Employee s residence status. Public servant or officer of a statutory authority who are nonresident by virtue of. Basically there are 4 part of section 7 of the income tax act 1967.

Section 7 of the ita clearly provides more than one situations when an individual taxpayer is considered a tax resident. It is determined by reference to the number of days an individual is present in malaysia during a particular calender year. 3 2 non resident means other than a resident in malaysia by virtue of section 8 and subsection 61 3 of the ita. For a year of assessment ya as determined under section 7 of the ita.

This is far from true. The individual has been resident in malaysia for 182 days of the tax year. Attending any course of study in any institution or professional body outside malaysia which is fully. Liability to tax is determined on a year to year basis.

Exercising his employment outside malaysia. Significance of residence status 4 1 residence status for income tax purposes residence status is a question of fact and is one of the main criteria that determines an individual s liability to malaysian income tax. B he is in malaysia in that basis year for a period of less than one.