Global Financial Crisis 2008 To 2009

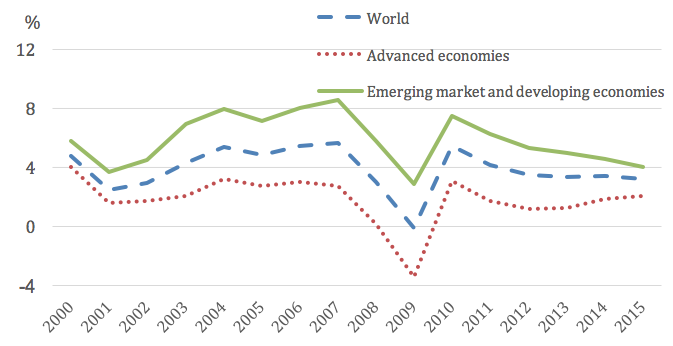

The global financial crisis that occurred in 2008 2009 was the worst financial crisis in 80 years even the economists in the world called it as the mother of all crises.

Global financial crisis 2008 to 2009. More than ten years on we explore whether or not we learned any lessons. The financial crisis of 2007 2009 has been called the worst. Although the global financial crisis. The subprime mortgage crisis in the united states eventually manifested into a world wide financial crisis.

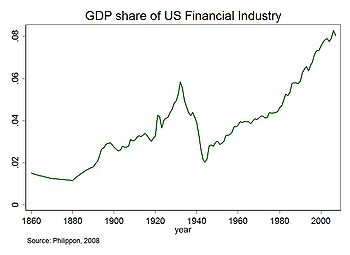

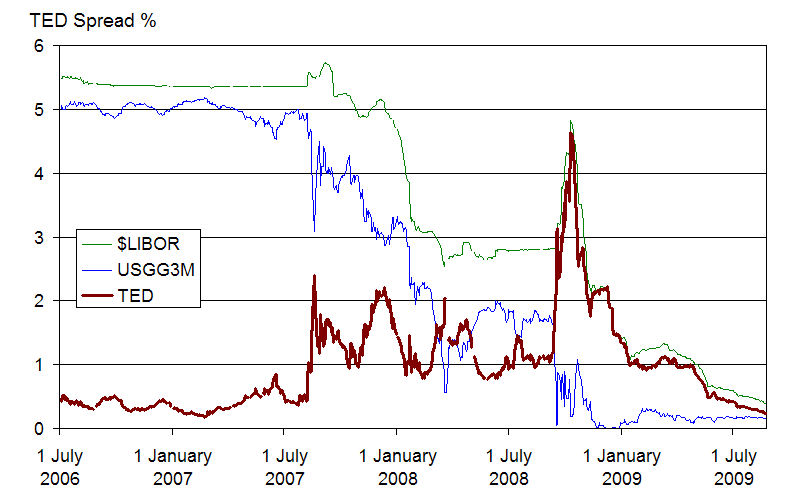

The falls in the dow jones and nasdaq share indices at the end of the year proved to be the most significant since 2008. The financial crisis of 2007 2008 also known as the global financial crisis gfc was a severe worldwide financial crisis excessive risk taking by banks combined with the bursting of the united states housing bubble caused the values of securities tied to u s. From sub prime to downgrade the five stages of the most serious crisis to hit the global economy since the great. The financial crisis of 2008 09 brought the global economy and investors to its knees.

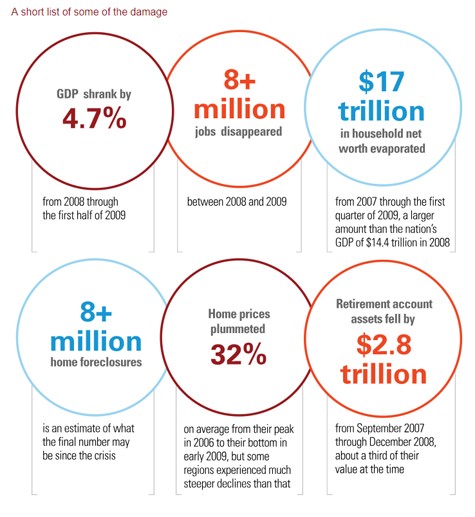

The financial crisis took its toll on individuals and institutions around the globe with millions of american being deeply impacted. The 2008 financial crisis has similarities to the 1929 stock market crash. In the last few months we have seen several major financial institutions be absorbed by other financial institutions receive government bailouts or outright crash. Financial institutions started to sink many were absorbed by larger entities and the us government was forced to offer bailouts.

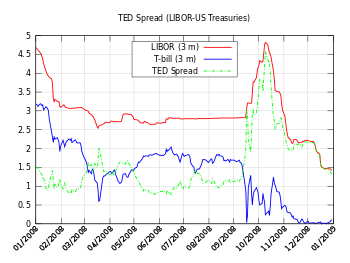

No single country is free from the effects including indonesia. The large run up in home construction and dwelling prices in the united states had started to turn by mid 2006 partly in response to rising policy rates and this was dampening the overall growth of the us economy. The global financial crisis of 2008 2009 refers to the massive financial crisis the world faced from 2008 to 2009. The financial market turmoil in 2007 and 2008 has led to the most severe.

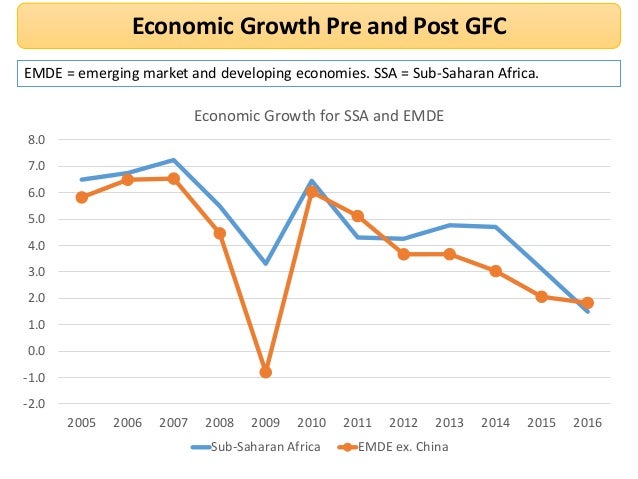

The pace of global activity had already been softening before the most intense phase of the financial crisis began in september 2008. Both involved reckless speculation loose credit and too much debt in asset markets namely the housing market in 2008 and the stock market in 1929.

/2008-financial-crisis-3305679-final-JS-03a006d464d7465aaf331145a1252beb.png)

/what-caused-2008-global-financial-crisis-3306176_FINAL-5c61ad8ac9e77c000159c893.png)