Epf Contribution Table For Age Above 60 2020

The age groups are.

Epf contribution table for age above 60 2020. Workers above 60 to 65 receive a 16 5 contribution rate with employers. 13 ref contribution rate. 22 feb 2020. Cpf contribution and allocation rates.

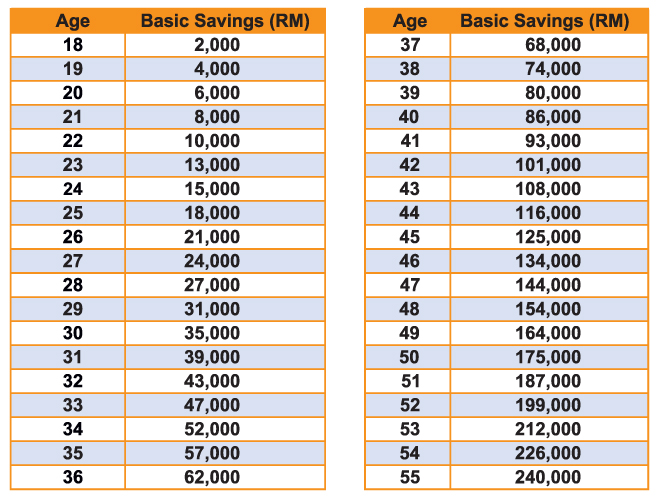

This will enable you to ensure your salary has been correctly deducted and also serve as proof of your epf contributions. For those who would like to know more about their contribution rate you can view the rates below up to the age of 60. The minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the employees share of contribution rate will be zero per cent. The minimum employers share of the employees provident fund epf statutory contribution rate for employees aged 60 and above has been reduced to 4 per month.

The new rates will apply from the first day of the month after the employee turns 50 55 60 or 65. Applicable for i only employees share. Below 60 years old stage 2 age 60 and above malaysian. 4 ref contribution rate section e rm5 000 and below.

Kuala lumpur jan 7. The employees provident fund epf announced that the minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to 4 per month while the employees share of contribution rate will be 0. Cpf contribution and allocation rates p cpf contributions are payable at the prevailing cpf contribution rates for your employees who are singapore citizens and singapore permanent residents spr p. For members aged 60 years and above the employees share of contribution rate will remain at 0.

50 years below above 50 to 55 years above 55 to 60 years above 60 to 65 years above 65 years. The 7 contribution rate will take effect from 1st april 2020 until the end of 2020 and it will be applicable to all epf members under 60 years of age that are subject to statutory contribution. Change of age group the cpf contribution rate changes as an employee moves to the next age group. Permanent residents pr non malaysians registered as member before 1 august 1998 no limit.

Meanwhile the employees share of contribution for this age group is set at zero the epf said in a statement today. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12.