Epf Contribution Table 2018

Epfo account 10 er a c 10.

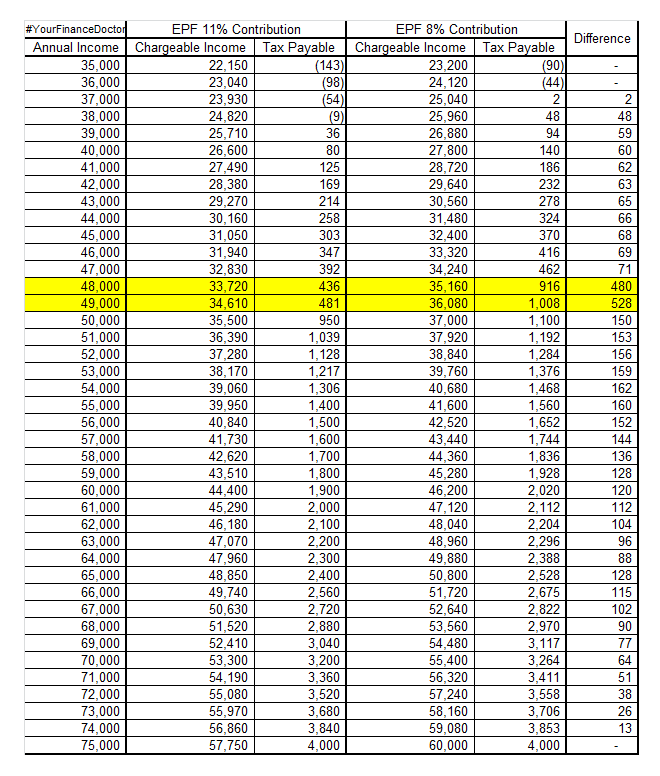

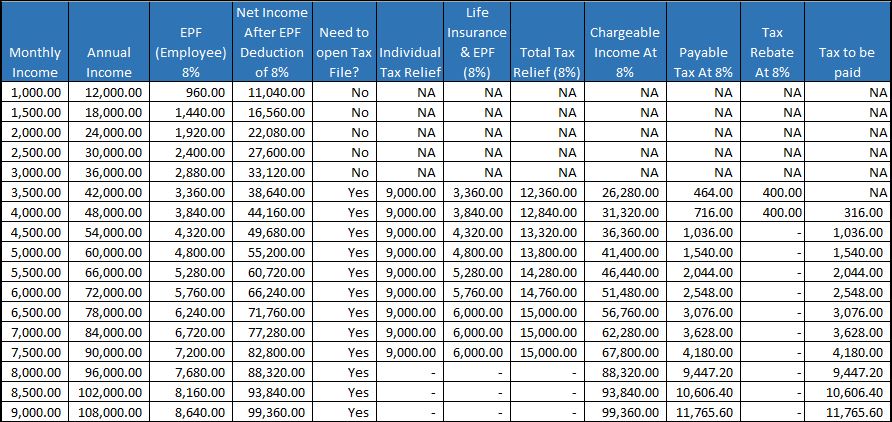

Epf contribution table 2018. As for the maximum contribution effective from january 2013 the maximum contribution for epf voluntary contribution including epf self contribution is capped at rm60 000 per year. Instead the statutory contribution rate for employee s share will revert to the original 11 for members below the age of 60 and 5 5 for those aged 60 and above. 01 06 2018 onwards 0 50 on total pay on which contributions are payable. Epf contributions tax relief up to rm4 000 this is already taken into consideration by the salary calculator life insurance premiums and takaful relief up to rm3 000.

The new rate will be effective for salaries from january 2018 onwards. Epf contribution third schedule. Jadual pcb 2020 pcb table 2018. Sip eis table.

Cpf contribution calculator for singapore citizens 3 rd year and onwards singapore permanent residents this calculator computes the cpf contributions payable for private sector non pensionable government employees who are singapore citizens or singapore permanent residents spr from their 3 rd year of obtaining spr status. Beginning january 2018 employees will no longer have the option of contributing 8 of their income to the employees provident fund epf. For the exact contribution amount refer to the contribution schedule jadual or head over to the epf contribution website. Online withdrawal application via i akaun has now been extended to age 50 years 55 years 60 years and withdrawal for savings more than rm 1 million.

Examples of allowable deduction are. During the online epf challan submission by the employer the pension fund contributed by the bye employer 8 33 goes into this account. Employers may deduct the employee s share from their salary. Epf inspection charges payable by the employers of exempted establishments period rate reckoned on.

Employers are required to remit epf contributions based on this schedule. Administration charges go into this account. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below the age of 60 and from 4 to 5 5 for those aged 60 and above. Minimum administrative charges payable per month per establishment is rs.

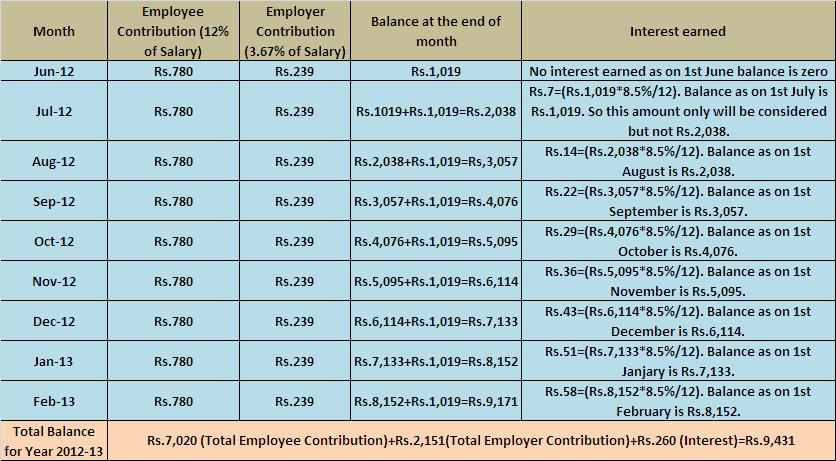

Salary for january 2018 therefore the contribution month is february 2018 and it has to be paid either before or on 15 february 2018. Total contribution paid by the employee is 12 and 12 1 13 is contributed by the employer. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download.