Capital Allowance Rate Malaysia

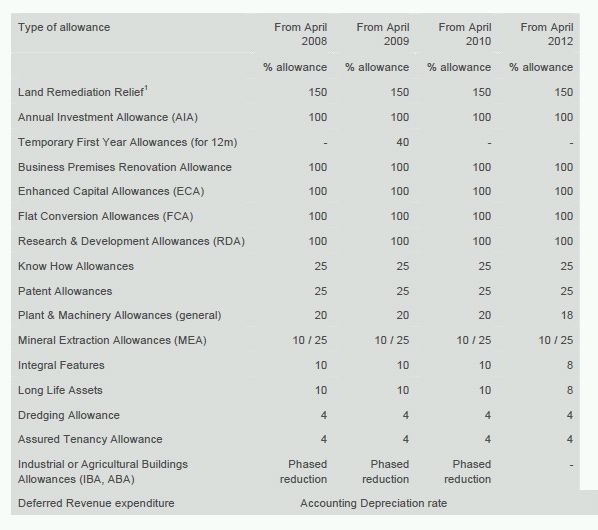

Current capital allowances rates for plant a2.

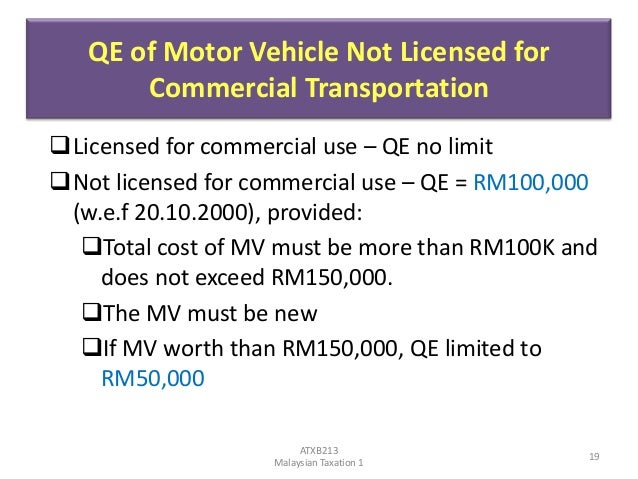

Capital allowance rate malaysia. L 125 l initial allowance annual allowance qualifying expenditure on private motor vehicles restricted to. Rm50 000 rm100 000 applies only to new vehicle with total cost not exceeding rm150 000 purchased on or after 28 oct 2000. Malaysia is taxed at the rate of 15 on income from an employment with a. All types of assets.

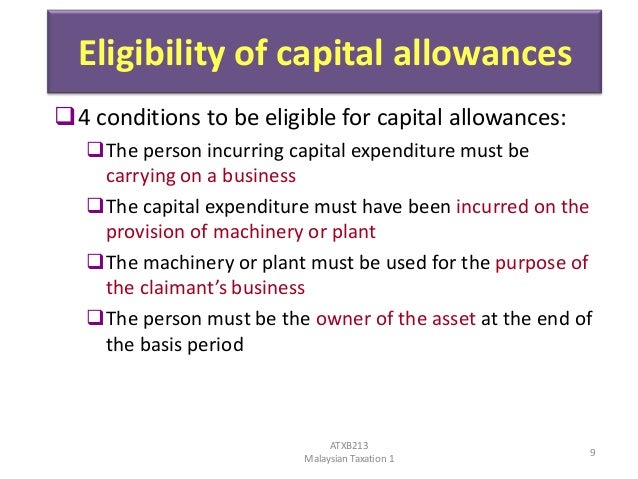

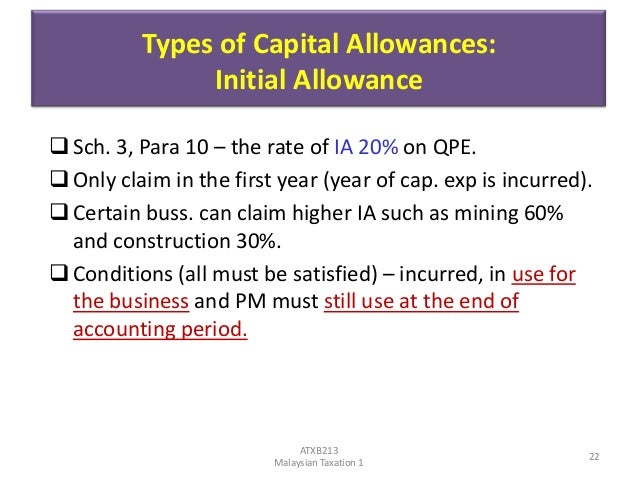

6 2015 date of publication. The total capital allowances of such assets are capped at rm20 000 except for smes as defined. Approval for exemption relief. 8 oktober 2018 inland revenue board of malaysia page 2 of 19 4 3 the conditions that must be fulfilled by a person to qualify for an initial allowance ia and an annual allowance aa are the same as the conditions to claim capital allowances at the normal rate under schedule.

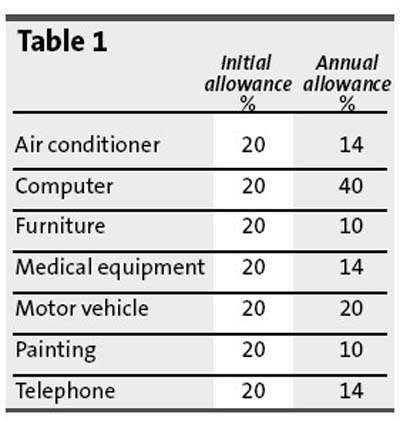

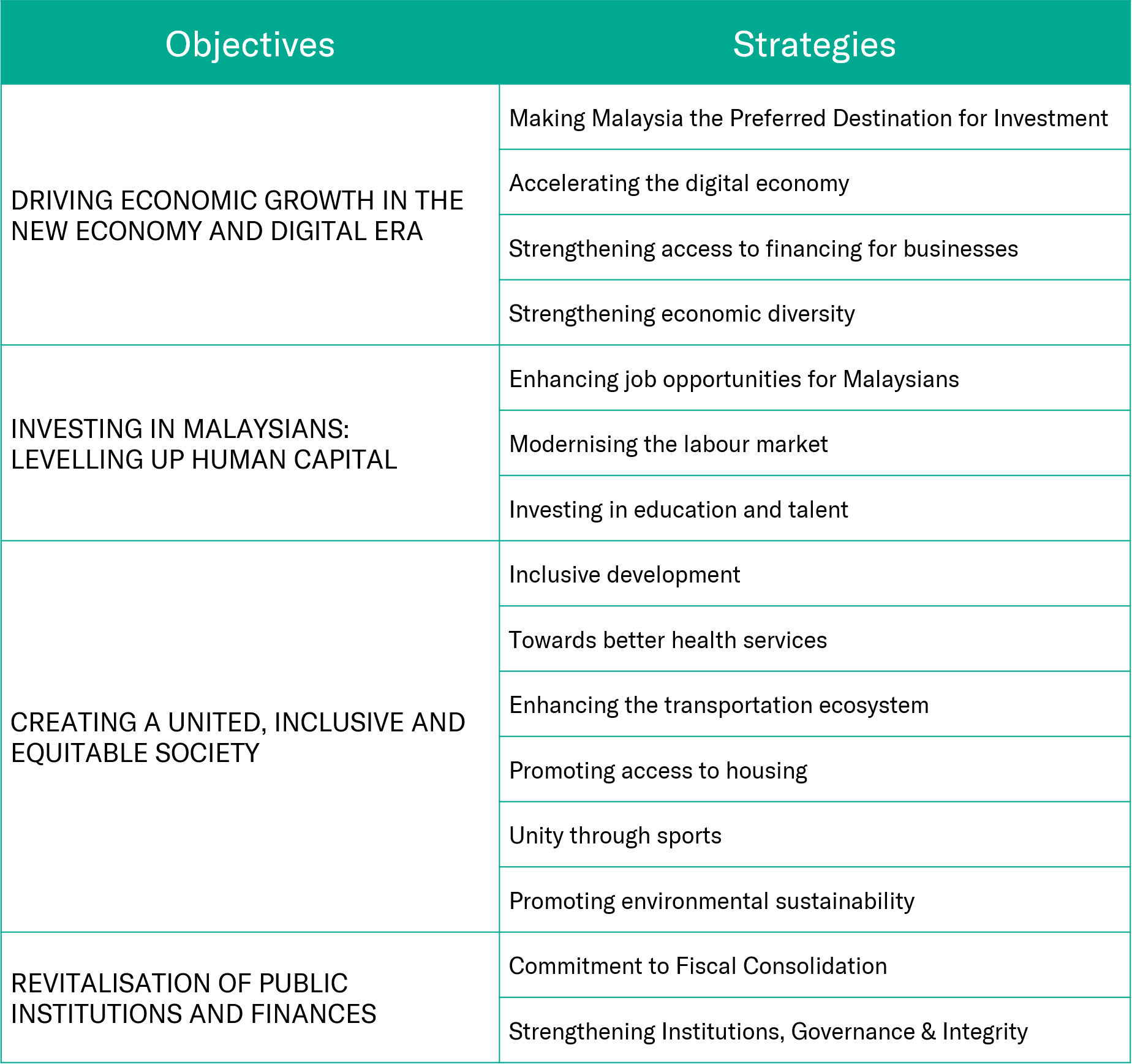

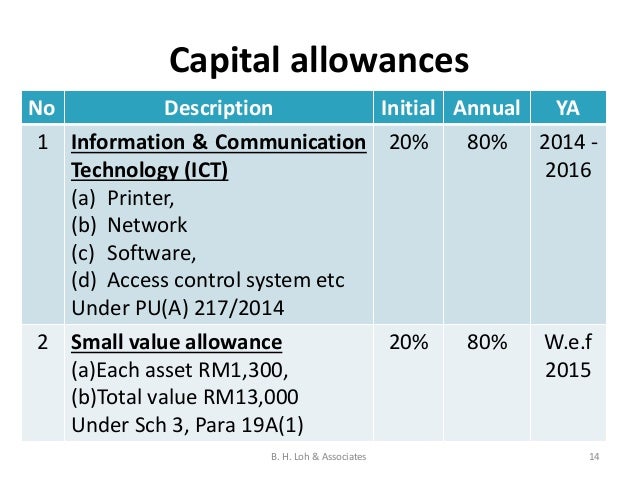

Capital allowances tax incentives income exempt from tax double tax treaties and withholding tax. The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. The rules allow for ca to be fully claimed on the development cost of customised software over four years by a resident person in malaysia based on an initial allowance of 20 and annual allowances of 20. Types and rate of capital allowance are as follows.

Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses. While annual allowance is a flat rate given every year based on the original cost of the asset. 7 2018 date of publication.

Allowance or deduction is published in the gazette. The income tax capital allowance development cost for customised computer software rules 2019 the rules have been gazetted on 3 october 2019. Special rates for plant. 27 august 2015 page 6 of 22 47 1 12 ia rm 23 8 2 0 x 20 4 76 4 aa rm 62 64 0 x 20 12 5 28 17 292 residual e xpenditure 29 8 2 0.

Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Rate initial allowance. 155 last update. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business.