Capital Allowance Rate Malaysia 2020

Average lending rate bank negara malaysia schedule section 140b.

Capital allowance rate malaysia 2020. 5 2014 dated 27 june 2014 refer. 8 2020 09 10 2020 refer year 2020. In january 2020 he sold it for rm600 000. Restriction on deductibility of interest.

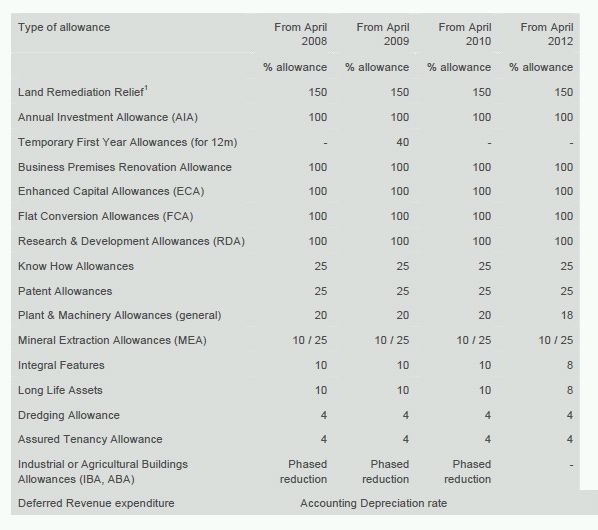

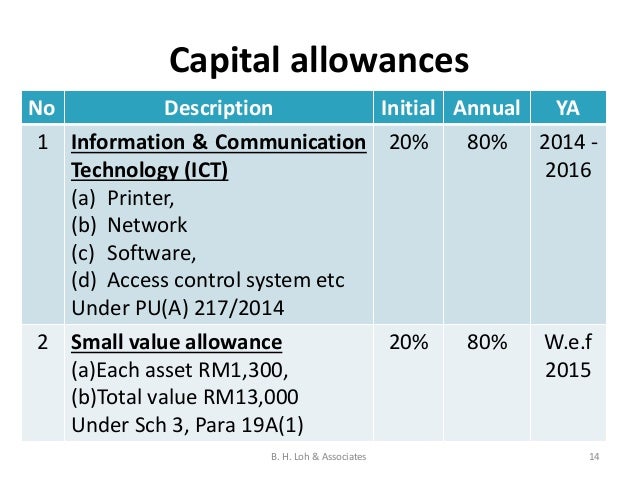

A new incentive has been proposed in the form of accelerated capital allowances and automation equipment allowances to encourage the transformation to industry 4 0 which involves the adoption of technology. The following are examples of capital allowance rates currently available. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. The total capital allowances of such assets are capped at rm20 000 except for smes as defined.

Foreign tax credit see foreign income in the income determination section for a discussion of the foreign tax credit regime. 200 automation capital allowance on first myr 2 million qce for years of assessment 2015 to 2020 proposed extension to year of assessment 2023. The following is a calculation of rpgt without regard to other costs that are eligible for deduction. 2019 2020 malaysian tax booklet this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices.

Restriction on deductibility of interest section 140c. Jared bought a house in 1990 for rm150 000. As sme is subject to income tax at the rate of 17 on the first rm500 000 of chargeable income. Ownership of plant and machinery for the purpose of claiming capital allowances superceded by public ruling no.

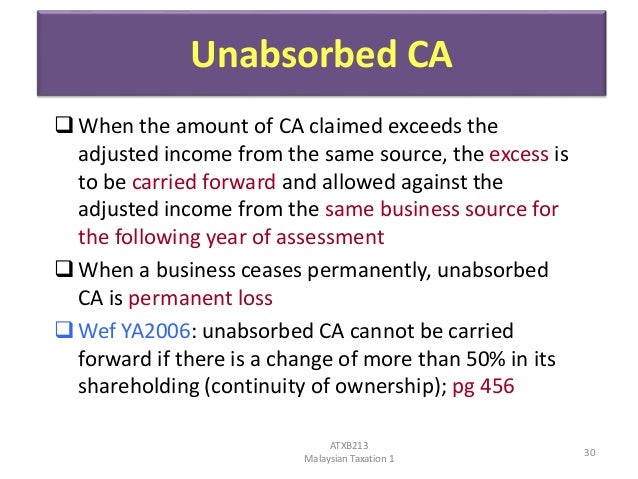

The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. Capital allowance tax depreciation on industrial buildings plant. Superceded by the public ruling no. While annual allowance is a flat rate given every year based on the original cost of the asset.

This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. 100 capital allowance on that qualifying expenditure. Malaysia corporate deductions last reviewed 01 july 2020. Average lending rate bank negara malaysia schedule section 140b.

Initial allowance annual allowance. Capital allowances consist of an initial allowance and annual allowance. Billion for the tourism sector in connection with visit malaysia year 2020.