Capital Allowance Rate Malaysia 2019

6 2015 date of publication.

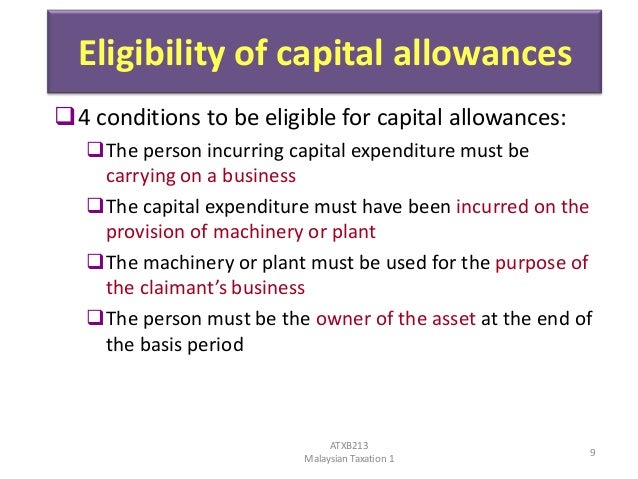

Capital allowance rate malaysia 2019. Ownership of plant and machinery for the purpose of claiming capital allowances superceded by public ruling no. 2019. Year of assessment 2019. 2018 2019 malaysian tax booklet.

The total capital allowances of such assets are capped at rm20 000 except for smes as defined. Superceded by the public ruling no. Qualifying expenditure and inland revenue board of malaysia computation of capital allowances public ruling no. 27 august 2015 page 7 of 22 aa restricted to 6 536 residual e xpenditure 0 b qe for a.

10 2019 10 12 2019 refer year 2019. Capital allowances tax incentives income exempt from tax double tax treaties and withholding tax. Average lending rate bank negara malaysia schedule section 140b. More than 160 000 was identified for one client in.

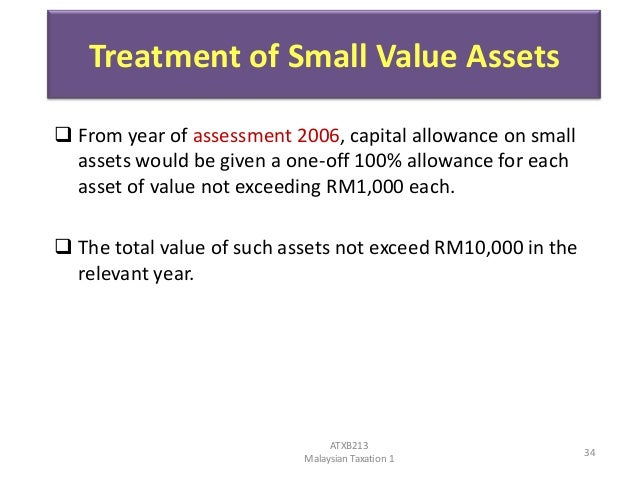

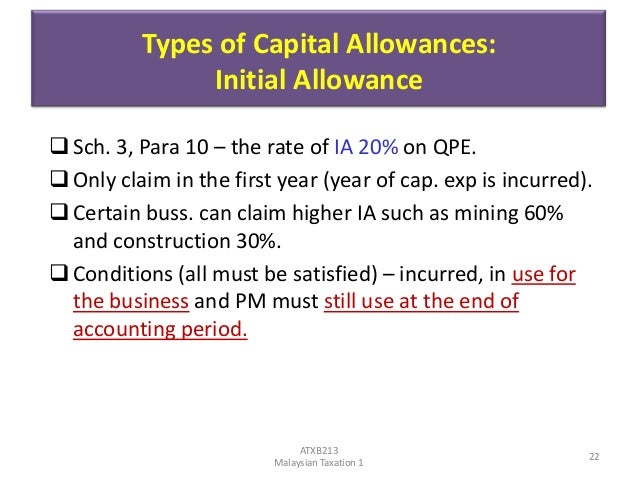

Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Restriction on deductibility of interest section 140c income tax act 1967. Average lending rate bank negara malaysia schedule section 140b.

Visitors this year. The reduced penalty rates for income tax. Company a can claim capital allowances on this 7 th piece of asset x over three years or over its useful life instead. While annual allowance is a flat rate given every year based on the original cost of the asset.

Capital allowances reinvestment allowances investment allowances and investment tax allowances can be carried forward indefinitely with limited exceptions. On 2 november 2018 malaysia released its 2019 budget. Assuming that capital allowances are claimed over three years the capital allowances for ya 2020 for this asset will be 1 467 4 400 3 years. The average on property improvements is 50.

The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. 5 2014 dated 27 june 2014 refer. The income tax capital allowance development cost for customised computer software rules 2019 the rules have been gazetted on 3 october 2019. 2018 2019 malaysian tax booklet personal income tax.

Malaysia is taxed at the rate of 15. With a person in malaysia for 5 consecutive yas. In total the capital allowance claim for ya 2020 will be 31 367 29 900. Capital allowance review service has acted for properties of all types from a chain of karaoke bars for which capital allowance savings of 412 791 were made to a property which a landlord rented out for which unclaimed capital allowances were identified to the tune of 22 of the property cost.