Capital Allowance Rate Malaysia 2019 For Computer

15 april 2013 contents page 1.

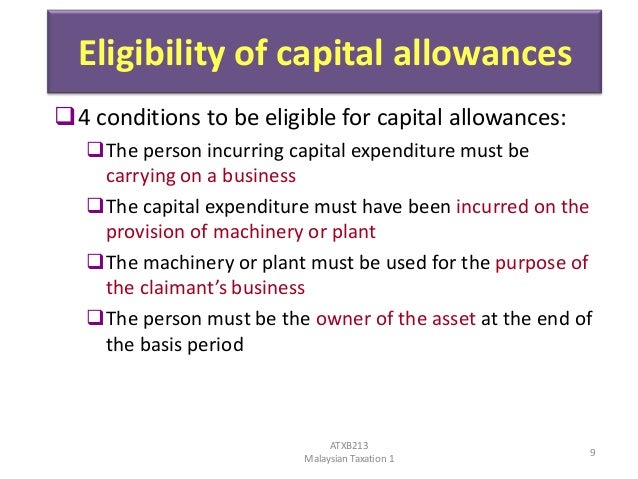

Capital allowance rate malaysia 2019 for computer. 8 oktober 2018 inland revenue board of malaysia page 2 of 19 4 3 the conditions that must be fulfilled by a person to qualify for an initial allowance ia and an annual allowance aa are the same as the conditions to claim capital allowances at the normal rate under schedule. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. The rules allow for ca to be fully claimed on the development cost of customised software over four years by a resident person in malaysia based on an initial allowance of 20 and annual allowances of 20. Qualifying expenditure 3 6.

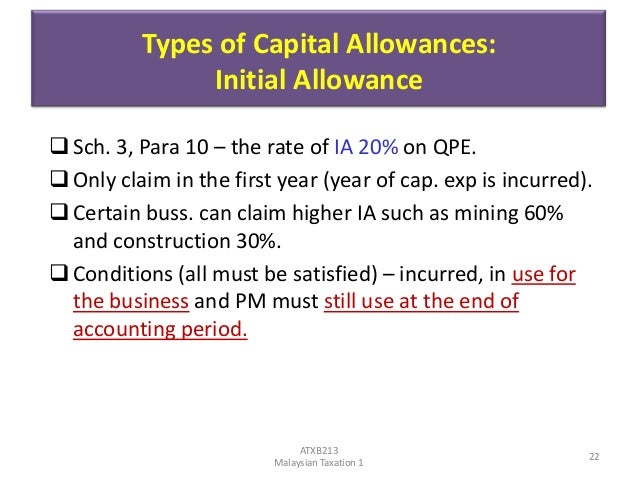

Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Assuming that capital allowances are claimed over three years the capital allowances for ya 2020 for this asset will be 1 467 4 400 3 years. 27 august 2015 page 7 of 22 aa restricted to 6 536 residual e xpenditure 0 b qe for a. Year of assessment 2019.

Inland revenue board of malaysia accelerate capital allowance public ruling no. Related provisions 1 3. Types and rate of capital allowance are as follows. Company a can claim capital allowances on this 7 th piece of asset x over three years or over its useful life instead.

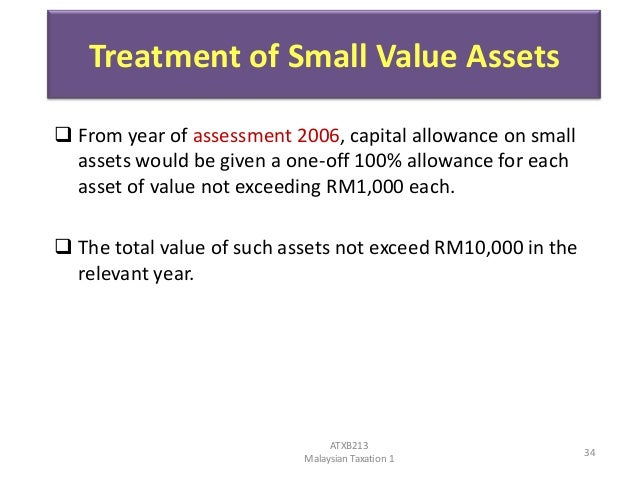

Office equipment furniture and fittings. The total capital allowances of such assets are capped at rm20 000 except for smes as defined. Capital allowance 3 5. Within 5 years after the end of the year the exemption relief remission allowance or.

Capital allowances consist of an initial allowance and annual allowance. Capital allowance development cost for customised computer software rules 2019 p u a 274 2019 in respect of the development cost for customised computer software which qualifies for the purpose of claiming capital allowance effective from year of assessment ya 2018. 2018 2019 malaysian tax booklet 13 reasons time frame exemption relief remission allowance or deduction granted for that ya under the income tax act 1967 or any other written law published in the gazette after the ya in which the return is furnished. Rate initial.

The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. 7 2018 date of publication. The income tax capital allowance development cost for customised computer software rules 2019 the rules have been gazetted on 3 october 2019. 2020 09 23 10 36 45 headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya.

20 hit s. Qualifying expenditure and inland revenue board of malaysia computation of capital allowances public ruling no. 6 2015 date of publication. In total the capital allowance claim for ya 2020 will be 31 367 29 900.

.jpg)