Capital Allowance Rate Malaysia 2018

Companies incorporated in malaysia with paid up capital or limited liability partnerships resident in malaysia with a total capital contribution of myr 2 5 million or less and that are not part of a group containing an entity exceeding this capitalization.

Capital allowance rate malaysia 2018. Qe for capital allowance claim is rm160 000. Superceded by the public ruling no. 75 of the cost incurred to be written off in the first year i e. Scenario 2 cost of preparing the site amounting to rm20 000 exceeds 10 of the aggregate cost rm17 000.

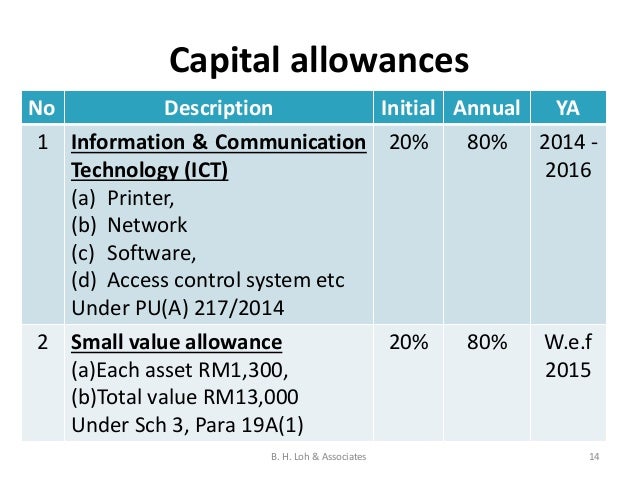

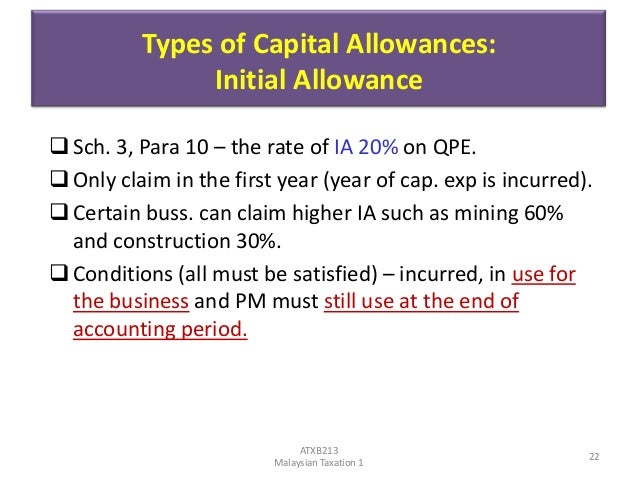

Capital allowances consist of an initial allowance and annual allowance. Qe for capital allowance claim is rm150 000 only. Types and rate of capital allowance are as follows. 8 oktober 2018 inland revenue board of malaysia page 2 of 19 4 3 the conditions that must be fulfilled by a person to qualify for an initial allowance ia and an annual allowance aa are the same as the conditions to claim capital allowances at the normal rate under schedule.

2020 09 23 10 36 45 headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. No deferment of capital allowance claim is allowed under this option. The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. Therefore no capital allowance will be given on the cost of preparing the site totaling rm20 000.

5 2014 dated 27 june 2014 refer. The total capital allowances of such assets are capped at rm20 000 except for smes as defined. 9 2018 12 10 2018 refer year 2018. Reduction of the income tax rate from 18 to 17 on the first myr 500 000 of chargeable income of small and medium sized enterprises i e.

All income of persons other than a company limited liability partnership co operative or trust body are assessed on a calendar year basis. 7 2018 date of publication. While annual allowance is a flat rate given every year based on the original cost of the asset. 155 last update.

Rate initial allowance. Average lending rate bank negara malaysia schedule section 140b. Regarded as part of the cost of machine. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

And 25 of the cost incurred to be written off in the second year i e. Ownership of plant and machinery for the purpose of claiming capital allowances superceded by public ruling no. Qualifying building expenditure qbe is capital expenditure incurred by a person on the cost of a constructing the original building which would include cost of constructing. Building allowances public ruling no.

Restriction on deductibility of. June 2018 is the fy ending 30 june 2018. 3 2018 date of publicaton. 12 september 2018 page 2 of 27 4.

Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances.

.jpg)