Capital Allowance Rate Malaysia 2010

Lee arrived in malaysia on 1 june 2010 and has been.

Capital allowance rate malaysia 2010. Capital allowances consist of an initial allowance and annual allowance. B6 capital allowances a1. 6 2015 date of publication. The total capital allowances of such assets are capped at rm20 000 except for smes as defined.

Standard rates with effect from y a 2000 cyb capital allowances are re categorised into three classes and the rates of capital allowances are revised as follows. Type of asset initial allowance rate annual allowance rate heavy machinery and motor vehicles 20 20 plant and machinery general 20 14 others 20 10. While annual allowance is a flat rate given every year based on the original cost of the asset. Inland revenue board of malaysia accelerate capital allowance public ruling no.

27 august 2015 page 6 of 22 47 1 12 ia rm 23 8 2 0 x 20 4 76 4 aa rm 62 64 0 x 20 12 5 28 17 292 residual e xpenditure 29 8 2 0. Assets for which the old rules or old rates have been applied for assets acquired before the basis period for y a 2000 cy for which both ia and aa have been allowed according to the existing rates i e the rates prescribed under the income tax qualifying plant annual allowances rules 1968 l n. Inland revenue board of malaysia computation of capital allowances public ruling no. Related provisions 1 3.

Tax rates and allowances are on pages 2 4. 4 2013 date of issue. Determination of taxable income capital allowances depreciation stock inventory capital gains. Qualifying expenditure 3 6.

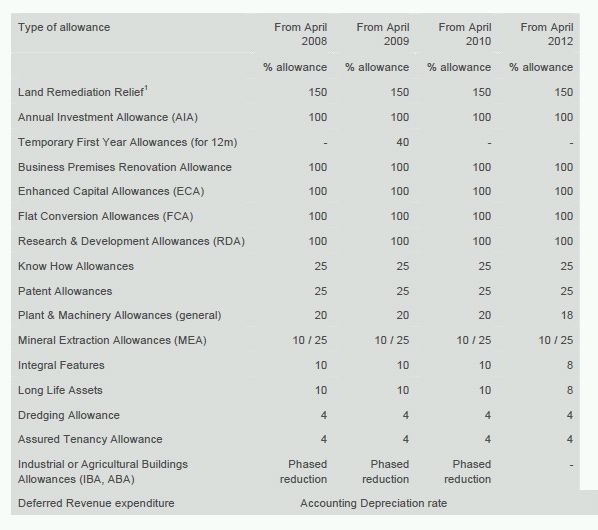

155 last update. The key change coming announced in 2010 but taking effect in 2012 is a phased reduction in the main and special rates of writing down allowances for plant and machinery. Taxes payable federal taxes and levies company tax capital gains tax branch profits tax sales tax value added tax fringe benefits tax local taxes other taxes b. Standard rates of allowances under schedule 3 of ita 1967 4 7.

Capital allowance 3 5. 15 april 2013 contents page 1. 2020 09 23 10 36 45 headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Types and rate of capital allowance are as follows.

Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Rate initial allowance. All types of assets. There is an unutilised capital allowance from the floor tile business of rm100 000 brought forward from the year of assessment 2009.

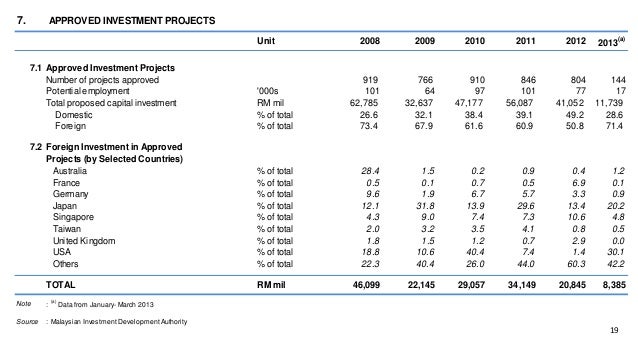

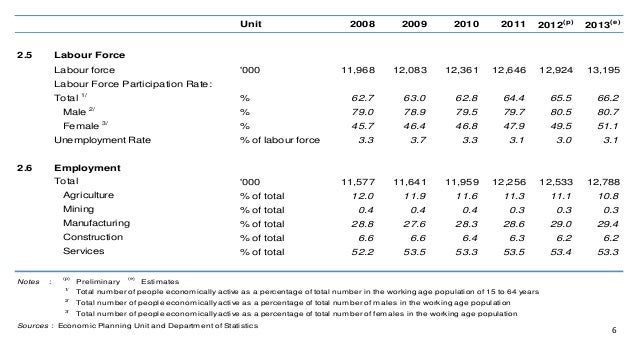

Pkf worldwide tax guide 2010 s t r u c t u r e viii structure of country descriptions a.