Capital Allowance Rate Malaysia 2000

While annual allowance is a flat rate given every year based on the original cost of the asset.

Capital allowance rate malaysia 2000. 75 of the cost incurred to be written off in the first year i e. Related provisions 1 3. 4 2013 date of issue. Standard rates of allowances under schedule 3 of ita 1967 4 7.

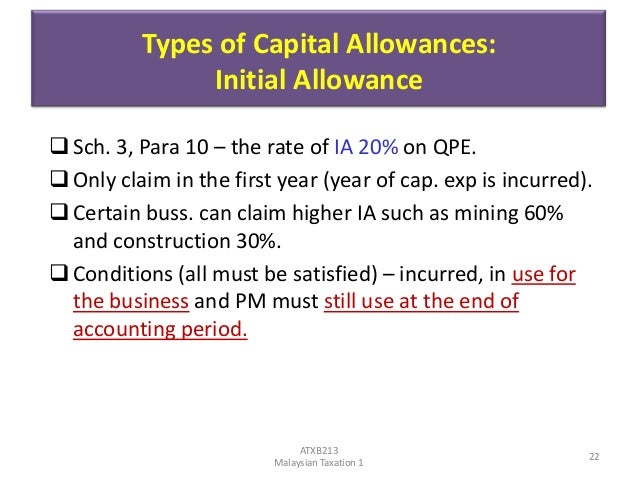

Initial allowance. Type and rate. And 25 of the cost incurred to be written off in the second year i e. No deferment of capital allowance claim is allowed under this option.

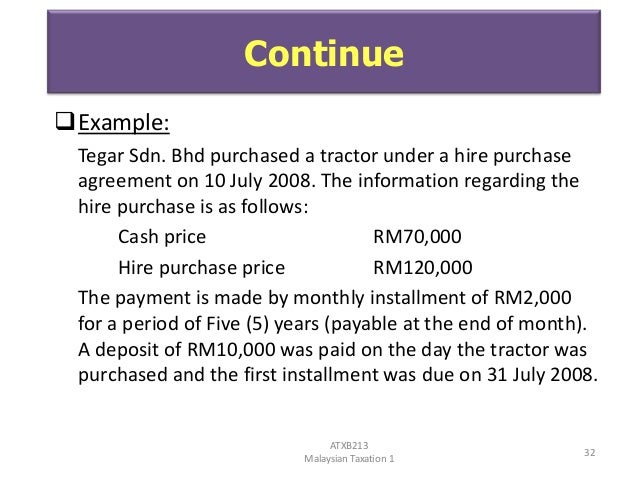

Type of asset initial allowance. Which is bought on or after 28 10 2000 has been increased from rm50 000 to rm100 000 on condition i. Type of asset initial allowance rate annual allowance rate heavy machinery and motor vehicles 20 20 plant and machinery general 20 14 others 20 10. Qe for capital allowance claim is rm160 000.

The rates of accelerated capital allowance allowed are as follows. Qe for capital allowance claim is rm150 000 only. B6 capital allowances a1. Standard rates with effect from y a 2000 cyb capital allowances are re categorised into three classes and the rates of capital allowances are revised as follows.

Capital allowances consist of an initial allowance and annual allowance. Regarded as part of the cost of machine. Qualifying expenditure 3 6. Capital allowance is only given to business activity.

Therefore no capital allowance will be given on the cost of preparing the site totaling rm20 000. 155 last update. The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. 20 small value assets of less than myr 2 000 subject to a maximum total cost of myr 20 000 100.

2020 09 23 10 36 45 headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. All types of assets. Example 1 a company which has been in business for a number of years purchases a refrigerator for rm5 000 on 12 04 2000. Types and rate of capital allowance are as follows.

3 3 computation of capital allowances for y a 2000 cy subsequent y a 3 3 1 new assets the amount of aa is a percentage of the qe incurred on the asset calculated according to the rates prescribed in the new rules. Malaysia contacts malaysia contacts. The following are examples of capital allowance rates currently available. Scenario 2 cost of preparing the site amounting to rm20 000 exceeds 10 of the aggregate cost rm17 000.

Rate initial allowance. 15 april 2013 contents page 1. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. Capital allowance 3 5.

.jpg)