Bank Islam Personal Loan 2017

Islamic personal loans are a part of islamic finance and personal loans from islamic banks in malaysia are more widely known as personal islamic financing.

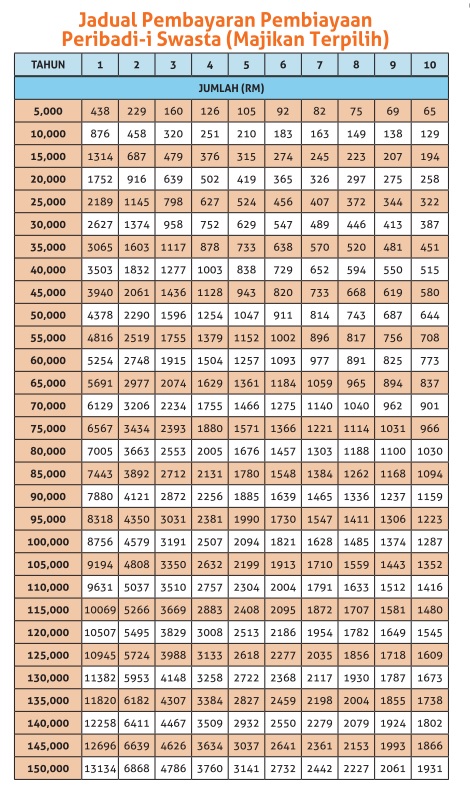

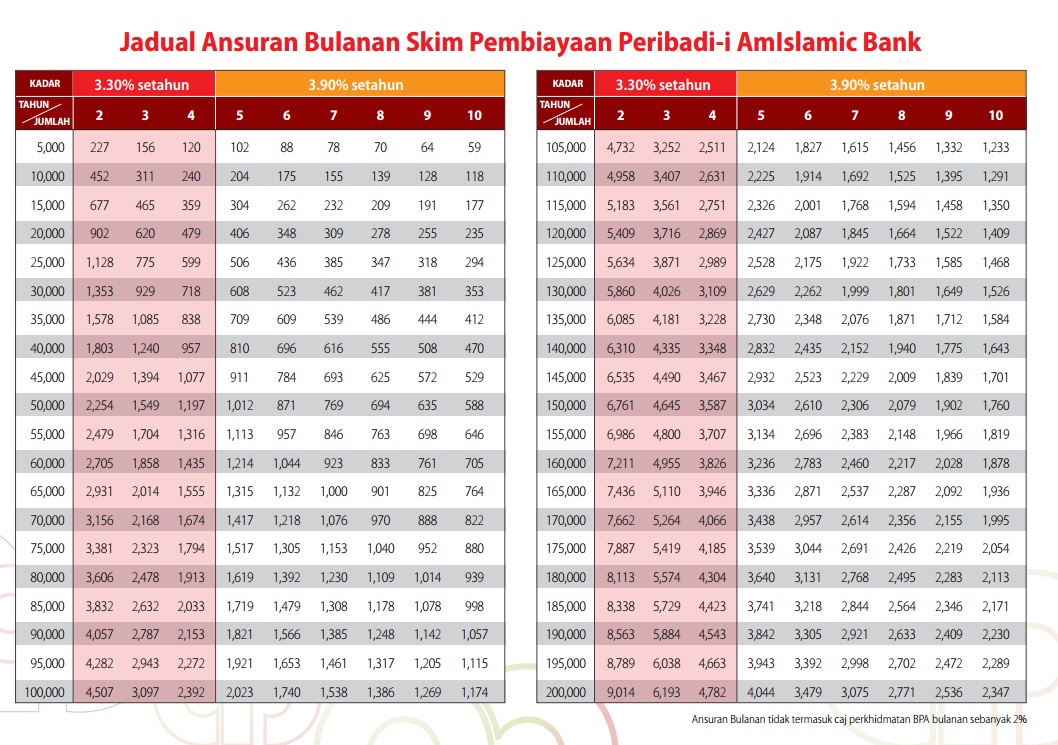

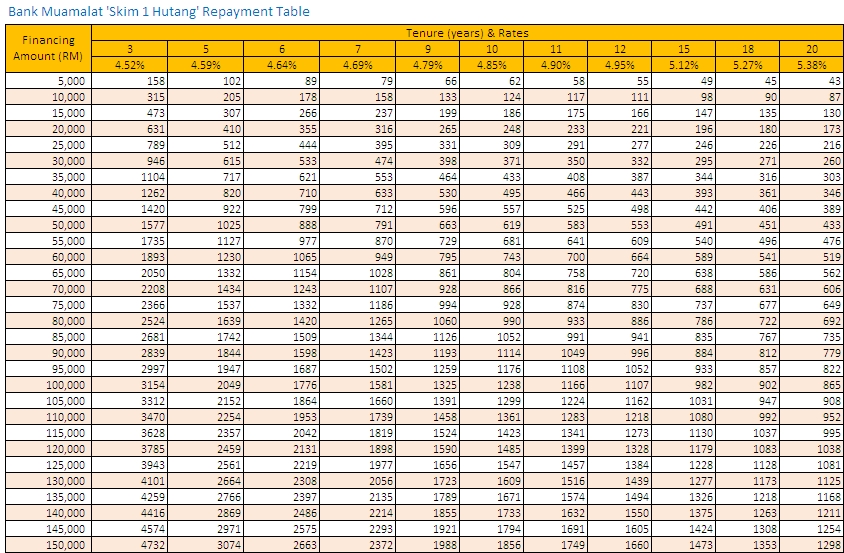

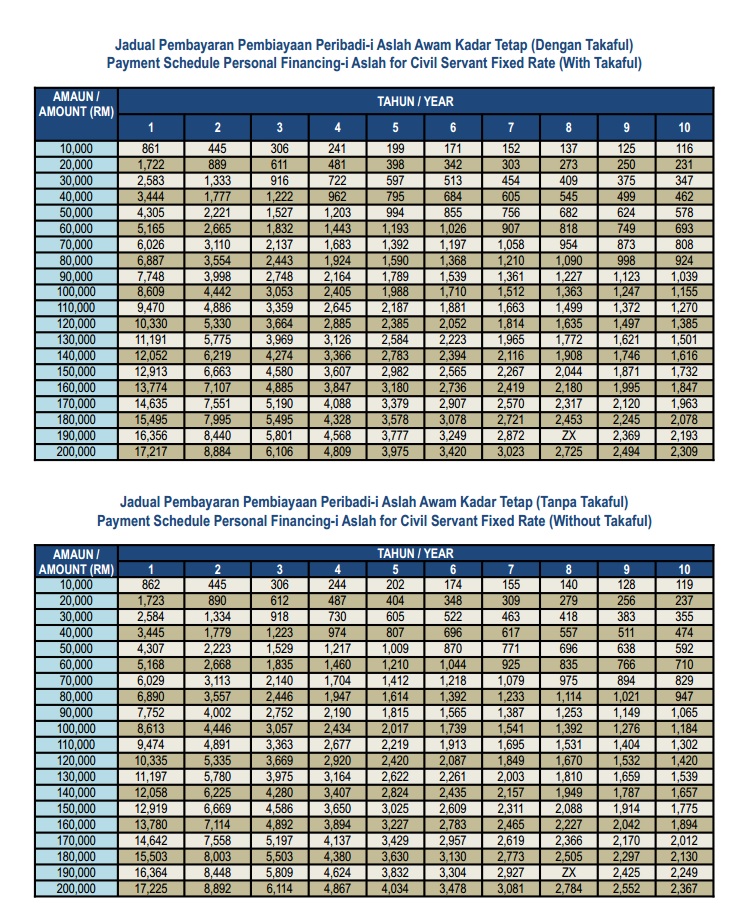

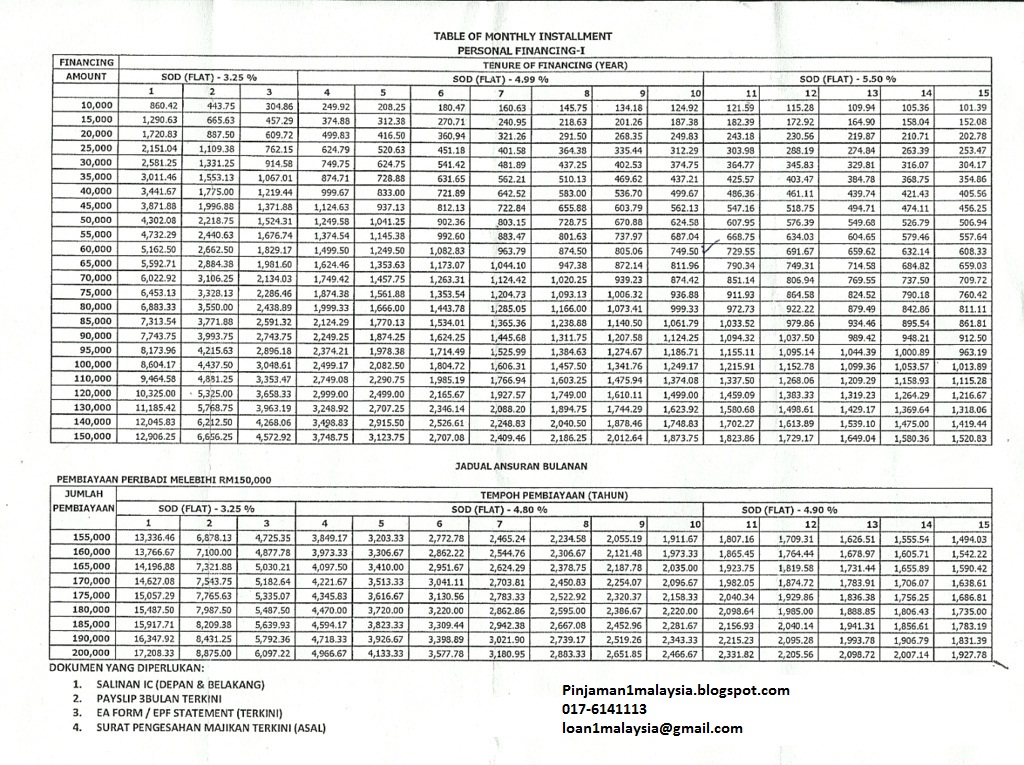

Bank islam personal loan 2017. Islamic banking adheres to shariah which is the islamic religious law as defined in the quran hadith and sunnah. Bank islam personal financing i package with bank islam personal financing i package the personal loan comes with an fixed interest rate starting from 4 9 p a. The maximum amount to be deducted is about 50 to 60 of salary. It has a maximum tenure of 10 years.

As of personal loans in malaysia there are no collateral nor guarantor is needed for the loan. Bank islam personal loan. It has made long strides to become a global leader in islamic banking and in upholding its status as the symbol of islamic banking in malaysia. The bank islam personal loan offers either fixed or floating interest rates.

The amount of loan available is from rm 10 000 to rm 200 000. Bank islam was established in 1983 to address the financial needs of malaysia s muslim. The personal loan also comes with a minimum income requirement of rm1 500. Bank islam is the pioneer of shariah based banking in malaysia and south east asia.

The loan amount would be subjected to criteria such as monthly income and credit score. The master prospectus of funds of asnb dated 30 june 2017 and supplementary prospectuses dated 15 december 2017 1 april and 9 july 2018 have been registered with the securities commission malaysia. This personal loan has a maximum tenure of 10 years.