Annual Return Section 68 Sample

Annual returns and accounts financial statements send back letters.

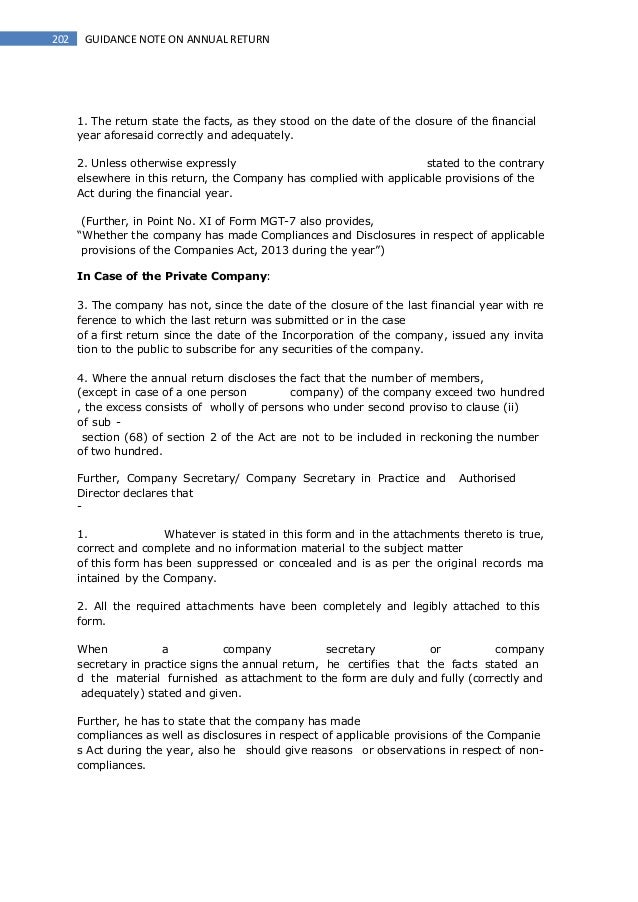

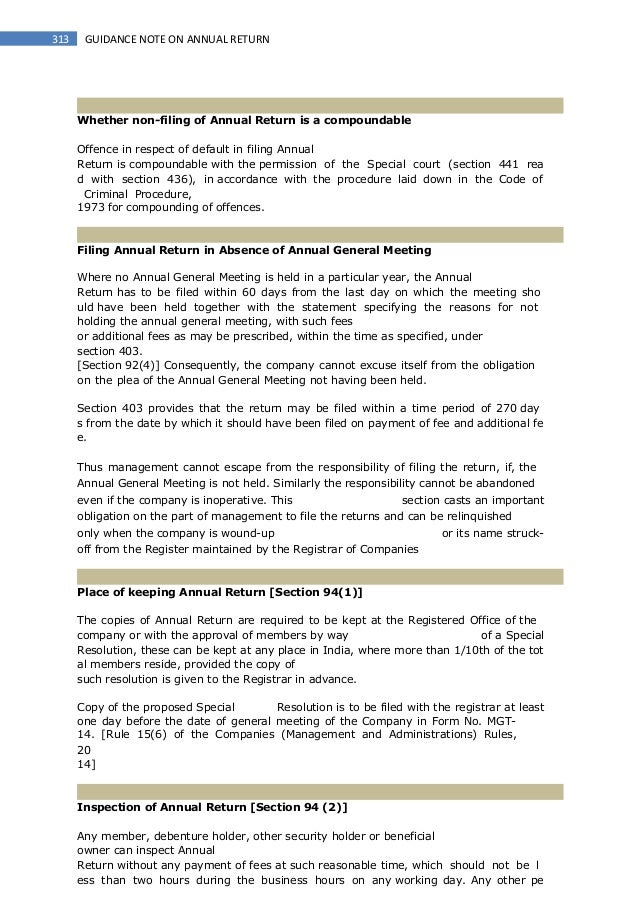

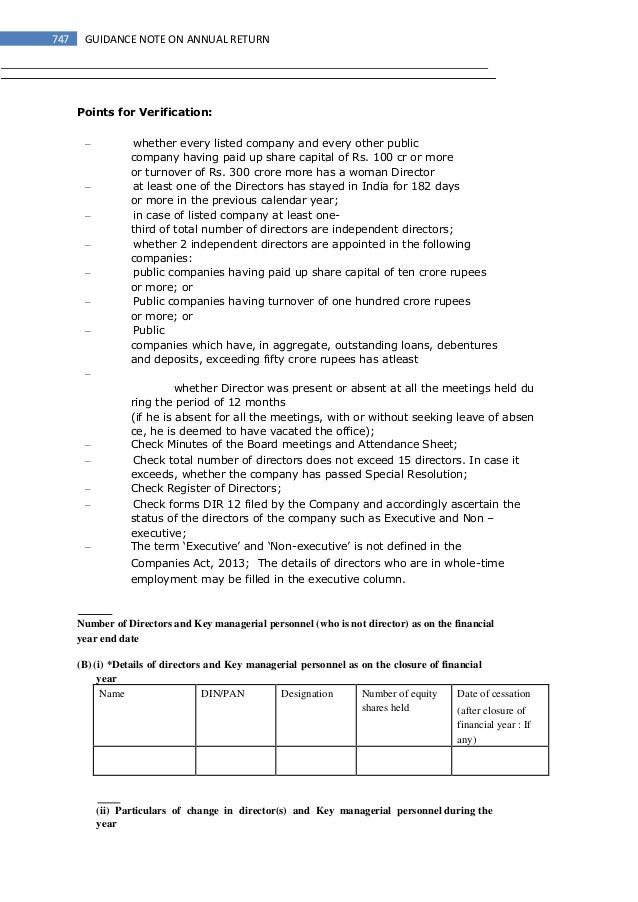

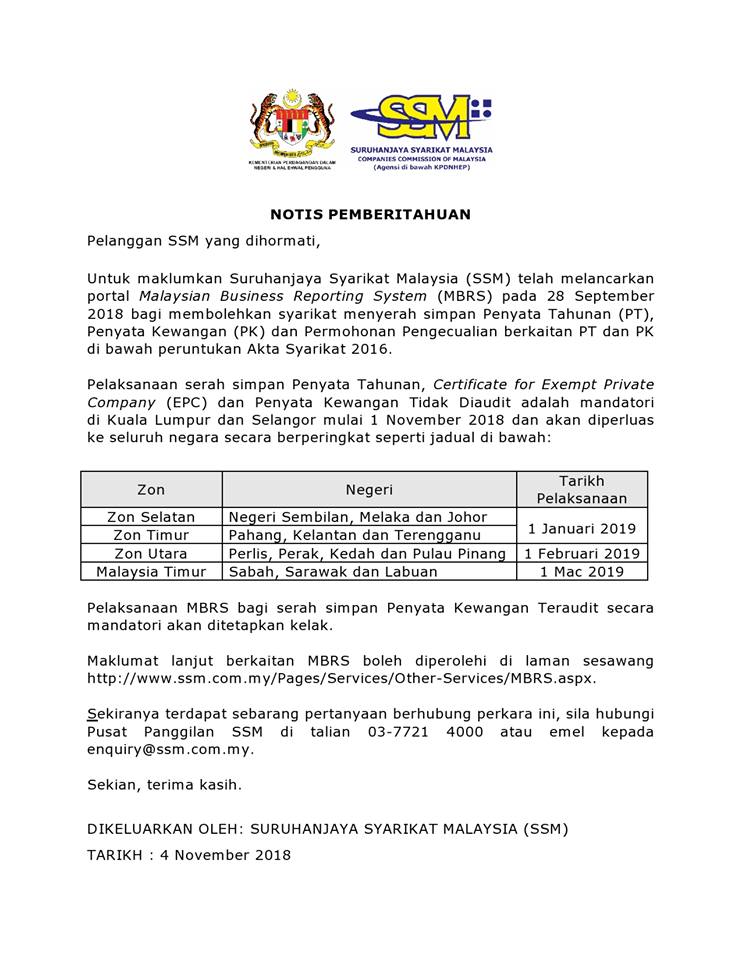

Annual return section 68 sample. An annual return is an electronic document setting out certain prescribed company information which is required to be delivered by an irish company whether trading or not to the cro please note that the cro public office is based in gloucester place lower dublin 1 on the corner with sean macdermott street. 2 the requirement under subsection 1 is not applicable to a company in the calendar year which it is incorporated. Duty to lodge annual return 1 a company shall lodge with the registrar an annual return for each calendar year not later than thirty days from the anniversary of its incorporation date. The annual return signed by a director or by the manager or secretary of the company shall be lodged with companies commission of malaysia ssm within one month from the date its agm held.

Annual return is a return stating yearly up to date information of a company as at anniversary date. For small company upload statement by director. Duty to lodge annual return section 68 companies act 2016 1 a company shall lodge with the registrar an annual return for each calendar year not later than thirty days from the anniversary of its incorporation date. Pursuant to section 68 of the companies act 2016 all private limited companies are required to lodge its annual return with the ssm within thirty 30 days from its anniversary of incorporation date each calendar year.

Based on option selected relevant section is displayed. As filing annual return is the most important legal requirement failure to do so is an offence and if convicted the company and its directors will face penalties under sections 165 and 169 of the companies act 1965. 2 the requirement under subsection 1 is not applicable to a company in the calendar year which it is incorporated. Complete the audit status section.

The annual return signed by a director or by the manager or secretary of the company shall be lodged with the suruhanjaya syarikat malaysia within one month after holding its agm or in the case of a company keeping pursuant to its articles a branch register in any place outside malaysia within two months after the annual general meeting. In simple words your annual returns will be due after 18 months of your company registration in malaysia. Small private companies small private companies refer to companies that fulfill at least 2 out of the 3 qualifying conditions 1. Revenue s 10m 2.

In light of the covid 19 situation acra will grant a 60 day extension of time for all listed and non listed companies whose agms are due during the period 16 april 2020 to 31 july 2020.